June 17th is the Deadline to File Non-Resident Alien Tax Returns. Request a 6-month Extension Now!

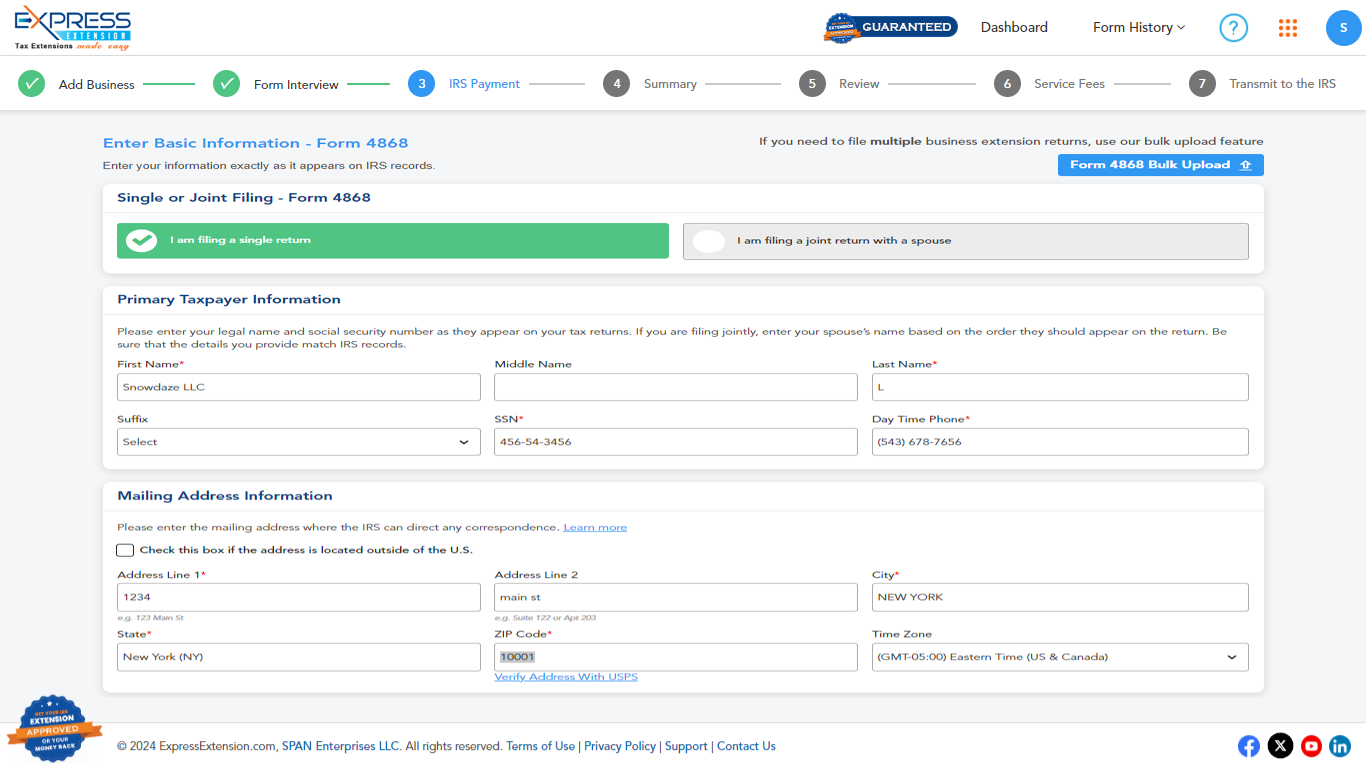

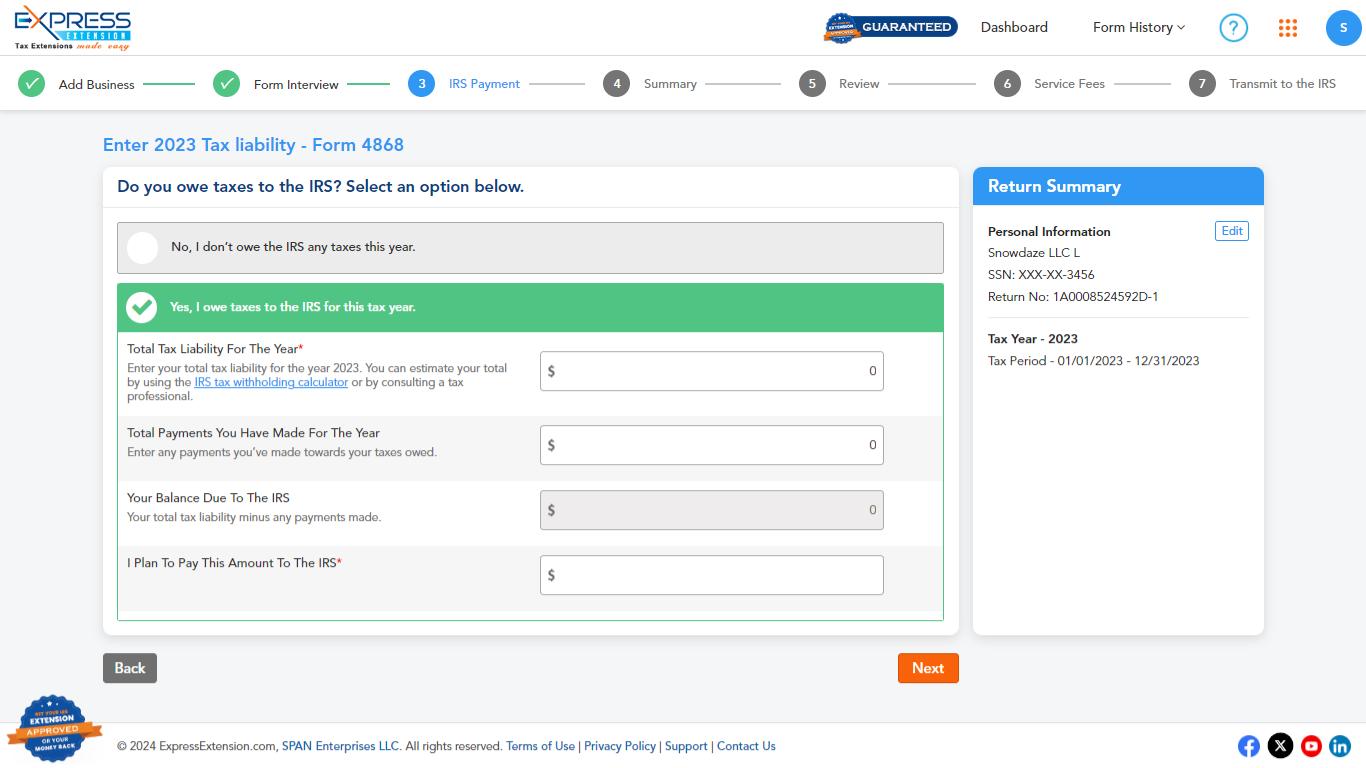

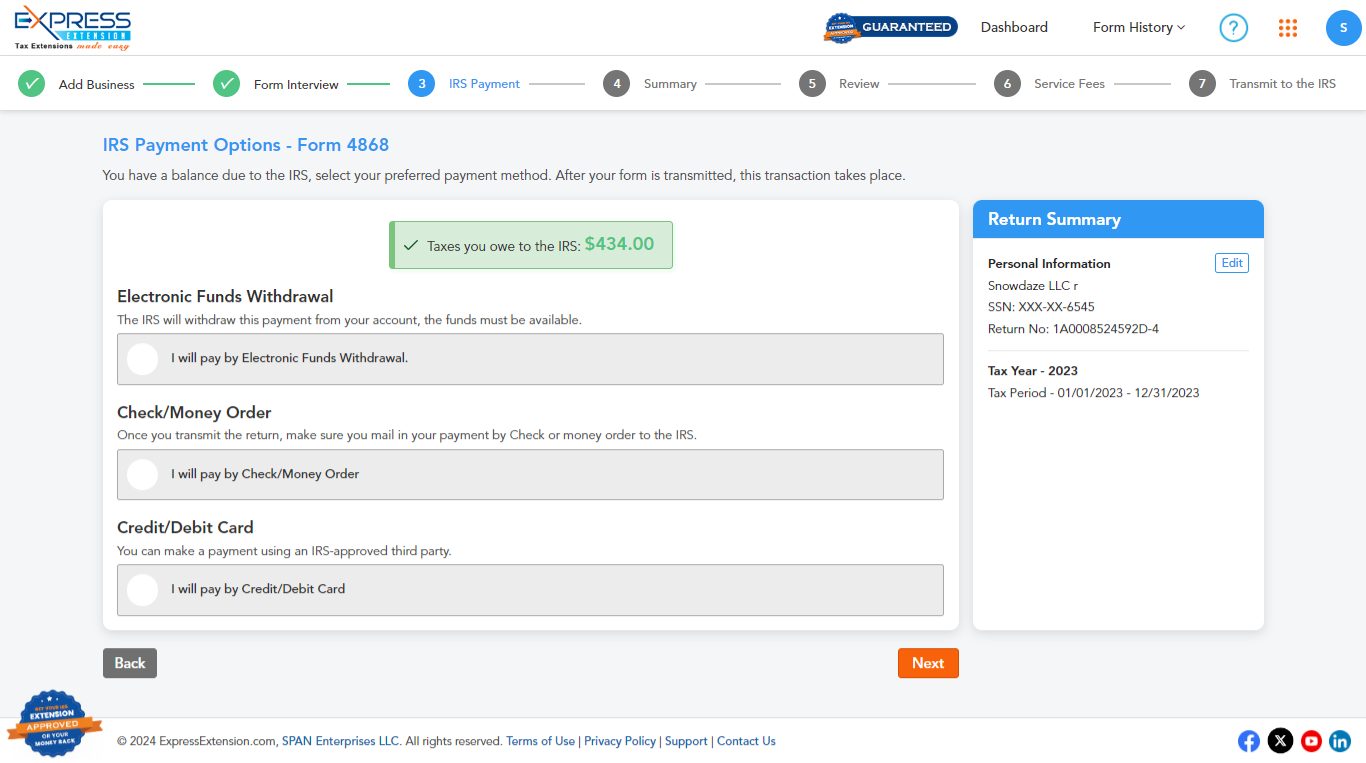

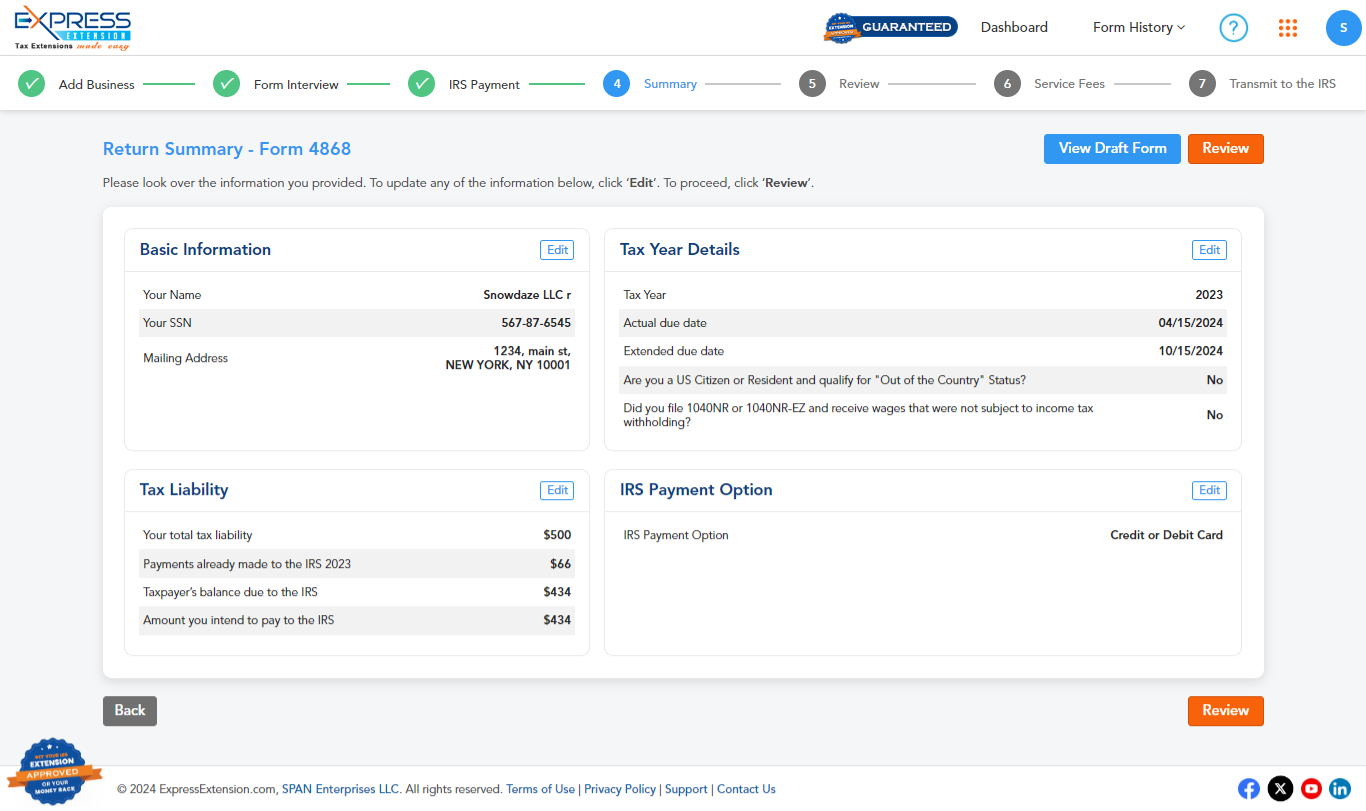

How to E-file Form 4868 electronically?

Get Started today and E-File Form 4868 from any device!

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners Choice

Pricing for E-filing Form 4868 with ExpressExtension

| Volume Based Pricing for E-Filing Form 4868 with ExpressExtension | |||||||

|---|---|---|---|---|---|---|---|

| No. of Forms | 1-10 | 11-50 | 51-100 | 101-250 | 251-500 | 501-1000 | 1000+ forms |

| For Business Owners | $12.95 | $11.95 | $10.95 | $9.95 | $8.95 | $7.95 |

Contact us for Bulk Pricing

803.514.5155 |

| For Tax Pros | $10.95 | $9.95 | $8.95 | $7.95 | $6.95 | $5.95 | |

Frequently Asked Questions

How does Express Guarantee work?

Under the Express Guarantee, if the Form 4868 you filed with ExpressExtension is rejected by the IRS as a duplicate filing, we will refund your filing fee.

When is the deadline to file a personal tax extension?

The deadline to file a personal tax extension Form 4868 is the same as the original deadline of the 1040 return you need to extend.

Generally, this deadline is the 15th day of the 4th month after the tax year ends. So, for the 2023 tax year, the deadline is April 15, 2024.

Can I pay the tax dues while electronically filing the 4868 extension?

Yes! When you e-file your Form 4868, you can choose to pay your tax balance due (if any) using either one of the following methods:

- Electronic Funds Withdrawal (EFW)

- Check or Money Order

- Credit or Debit Card

What is an Electronic Postmark?

Generally, an electronic postmark indicates the actual date and time (as per the taxpayer's timezone) the extension is received by the transmitter through e-filing. The IRS accepts the extension request if the electronic postmark is on or before the deadline.

What is the Perfection Period for my 4868 extension?

The perfection period is the additional time allowed by the IRS to correct and retransmit the rejected extensions.

The perfection period for the extension Form 4868 is 5 calendar days.

Need More Assistance?

Our team is here to help you via live chat, phone, and email. You can also check out our Knowledge Base for FAQs and helpful articles.