IRS Form 8868 Mailing Address

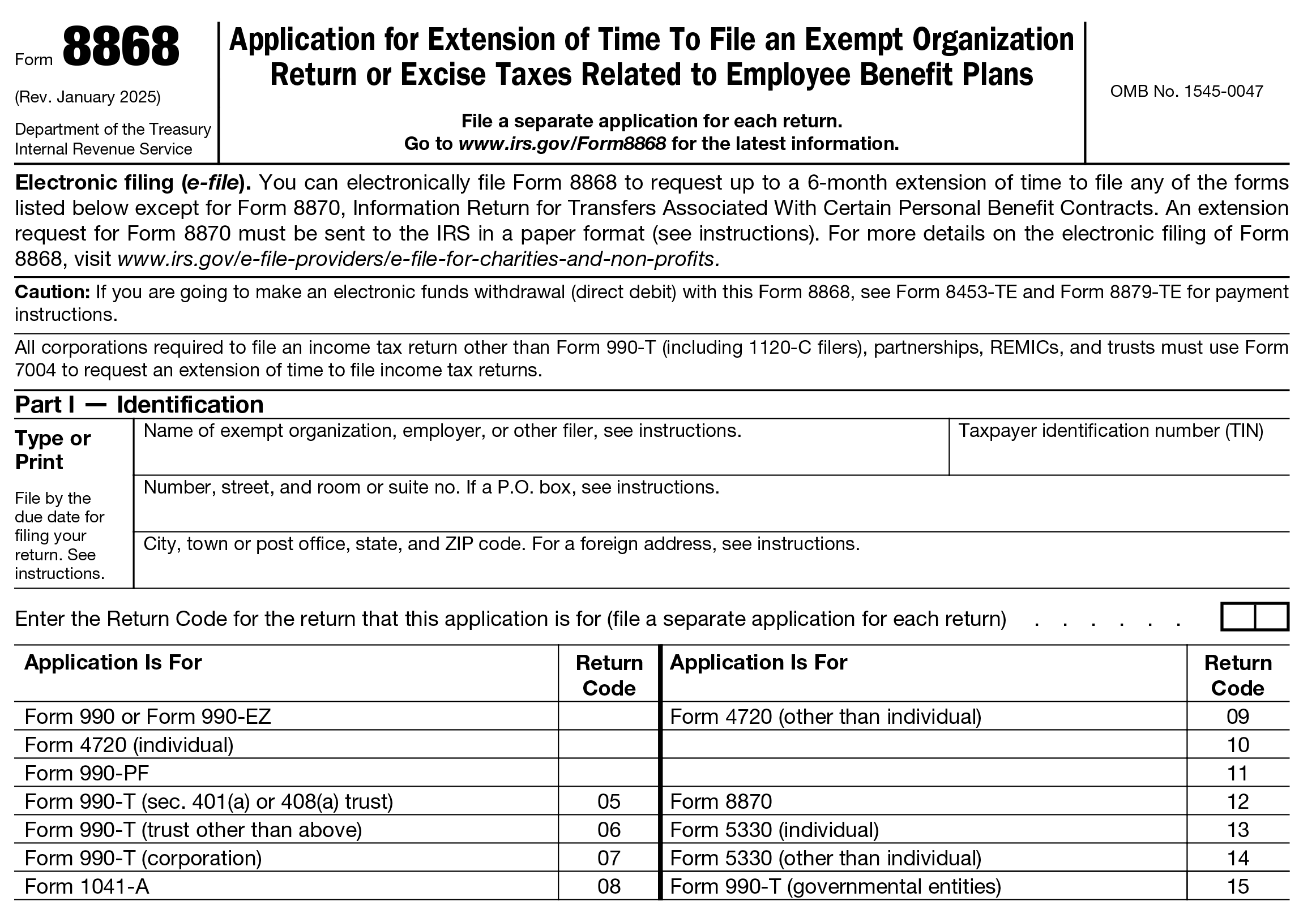

- Updated December 6, 2024 - 8.00 AM Admin, ExpressExtensionIRS Form 8868 is the Application for Automatic Extension of Time To File an Exempt Organization Return. This form is generally used by nonprofits and tax-exempt organizations to extend their deadline to file 990 returns and certain other tax returns.

You can either file a paper copy of Form 8868 or you can file electronically. While e-filing is the

IRS-recommended method of filing, you can find the mailing address for submitting the extension below.

Table of Contents

Which Forms Can You File a Form 8868 Tax Extension for?

Form 8868 can be filed to request an extension of time to file the following nonprofit

tax returns.

- Form 990 or Form 990-EZ

- Form 990-PF

- Form 990-T (For sec. 401(a) or 408(a) trust, other trusts, and Corporations)

- Form 4720 (For individuals and other than an individual)

- Form 1041-A

- Form 5227

- Form 6069

- Form 8870 (Paper filing)

Form 8868 Filing Due Date

Generally, the IRS requires you to file Form 8868 on or before the deadline for the return you are requesting the extension for.

For example, if you need an extension for filing Form 990, the deadline to file Form 8868 is the 15th day of the 5th month after the organization’s accounting period ends. So, if your organization follows a calendar tax year, the deadline is May 15th.

Form 8868 Filing Methods

As mentioned earlier, Form 8868 can be filed either on paper or electronically. However, the IRS encourages filers to e-file Form 8868 for more efficient processing.

There is an exception, if you are requesting an extension of time to file Form 8870, the IRS requires you to file a paper copy of Form 8868.

Form 8868 Mailing Address

Organizations that choose to send a paper copy of Form 8868 must complete and send the application to:

Internal Revenue Service Center,

Ogden, UT 84201-0045.

An application for an extension of time to file Form 8870 must be sent in paper format to the address above. Do not file for an extension of time by attaching Form 8868 to the exempt organization’s return when it is filed.

What are the changes made to Form 8868 for the upcoming tax year 2024?

The IRS has recently released the draft version of Form 8868 for the 2024 tax year. Apart from the existing tax forms, the filers can now use Form 8868 to request an extension for one more form, i.e., Form 5330 (individuals & other than individuals)

Form 5330 is an IRS form that individuals or entities can file to report and pay any taxes that are in relation to employee benefit plans.

The filers requesting an extension for Form 5330 must provide some additional information such as Plan Name, Plan Number, and Plan Year Ending.

Besides, the IRS has also added a new part - Part III (Extension of Time To File Form 5330), which the filers must complete.

Note: The changes made in draft forms may be subjected to changes until the final release.

Advantages of E-filing over paper filing

When it comes to filing tax forms with the IRS, e-filing is the most efficient and convenient method. Here are some of the advantages of choosing to

e-file your 8868 tax extension

- E-filing is simple, convenient, and secure

- There’s no paperwork involved

- The IRS provides status updates on e-filed forms

- E-filing reduces time spent filing and errors

Choose ExpressExtension to E-File Form 8868 Efficiently

E-filing IRS Form 8868 with ExpressExtension is easy and efficient. You can complete the extension form and transmit it to the IRS in minutes.

Check out the awesome filing features that you’ll only find with ExpressExtension!

- Quick, Easy, and Secure

- Instant IRS updates

- File from any device

- Options to pay your taxes due

- Free retransmission of rejected returns

- Live Customer Support

How do I E-File Form 8868?

Enter your Organization Details

Choose the return type you would like to extend

Choose the organization's tax year

Review your return and fix errors, if any

Pay and transmit the return to the IRS

Ready to e-file Form 8868?

E-file NowArticle Sources for Form 8868:

Helpful Resources about Form 8868