How to file Personal Tax Extension Form 4868 for the

2024 tax year?

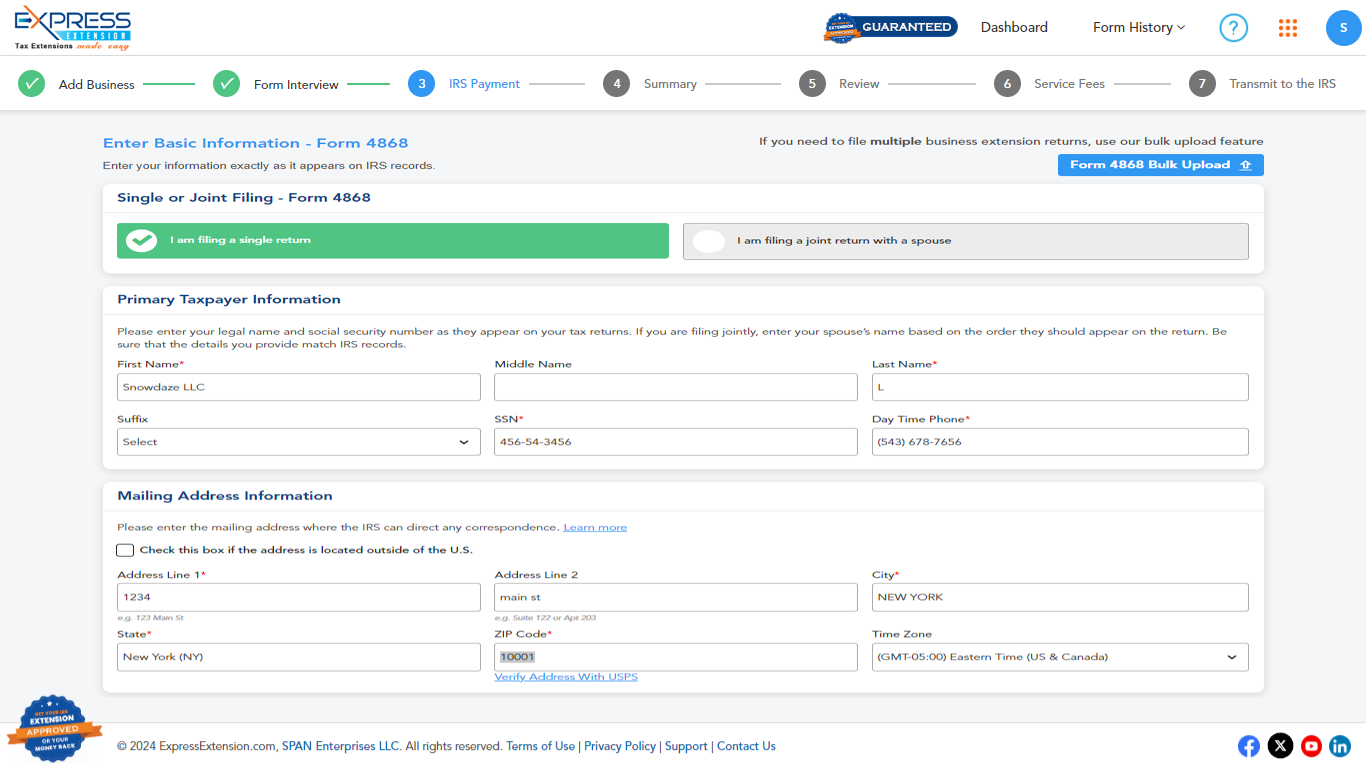

Enter your details, SSN, Address, and Mobile Number to start filling out the form

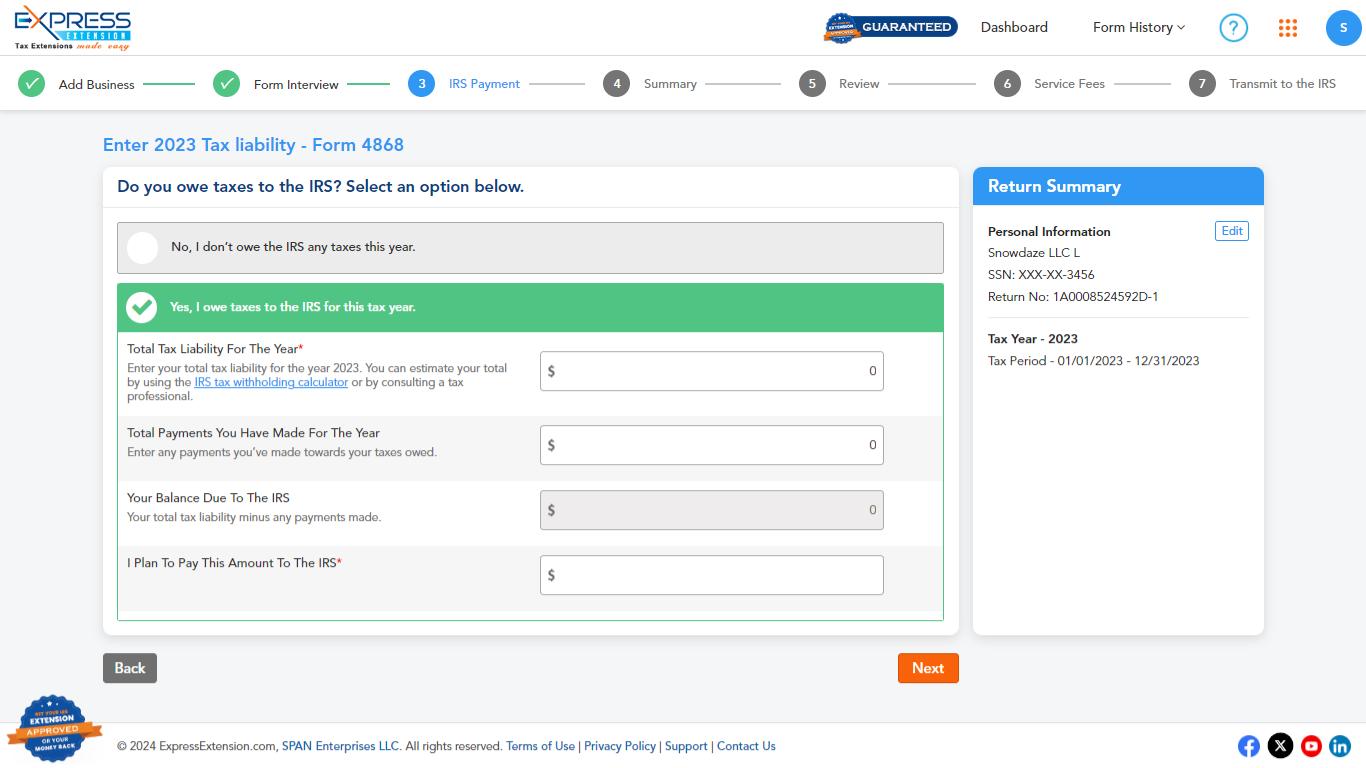

Choose whether you owe any taxes to the IRS

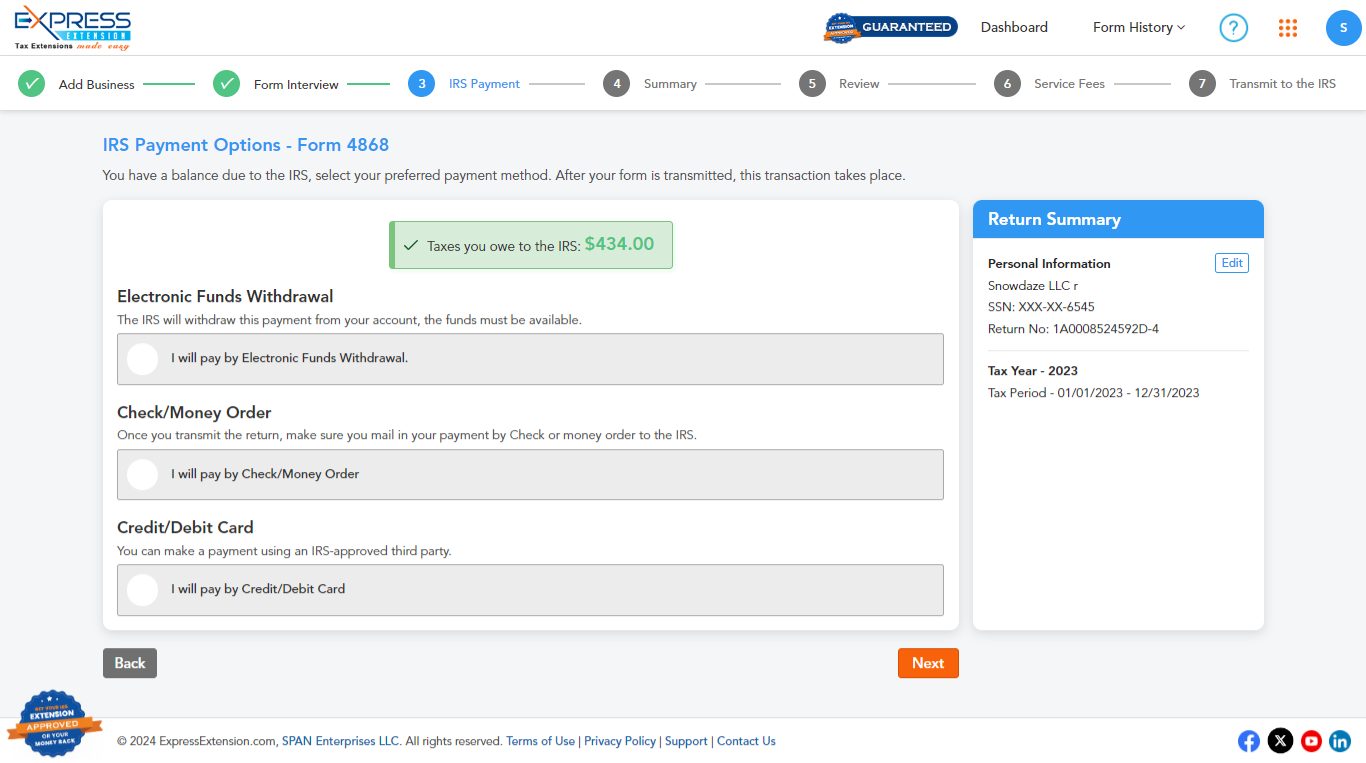

Select the payment mode you need to transmit to the IRS

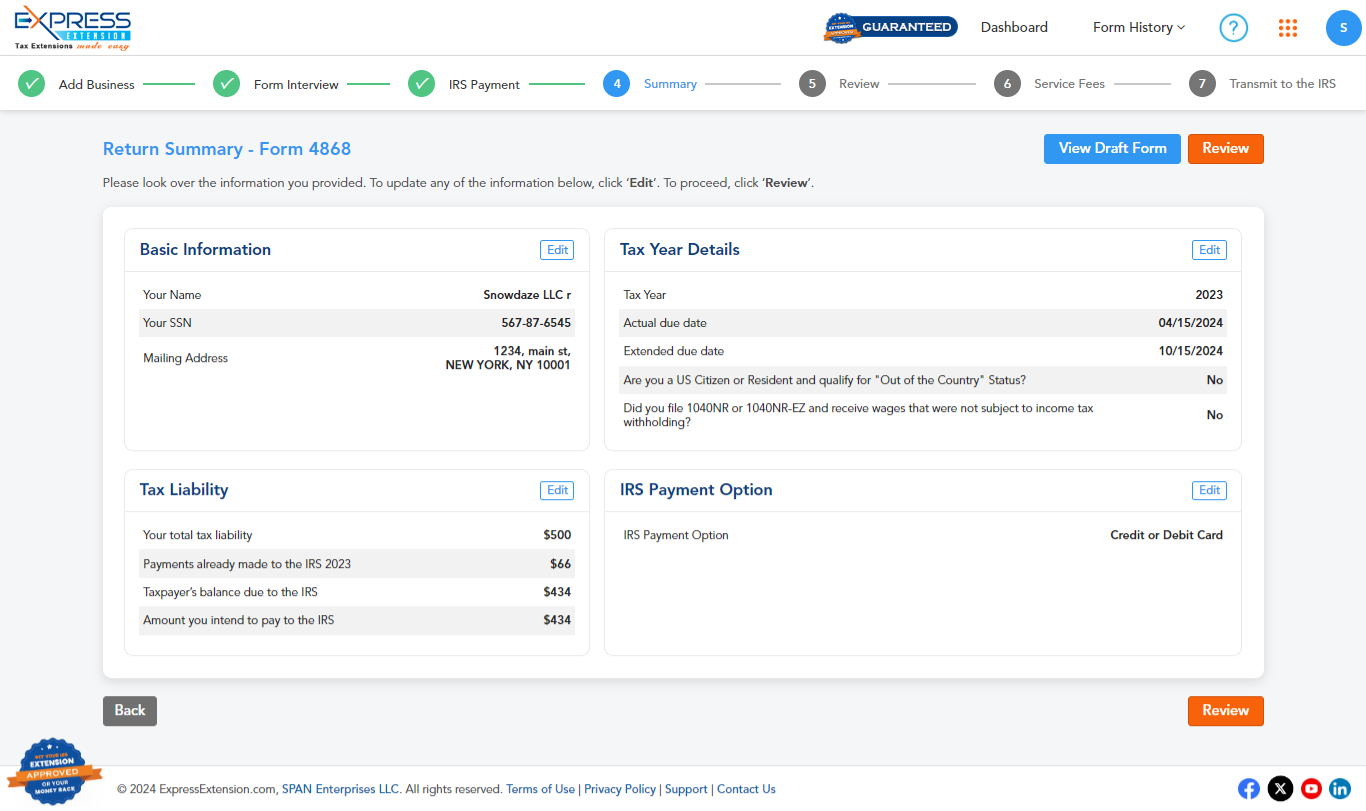

Once you choose the payment mode, review your form

Once reviewed, you can transmit the return to the IRS.

Ready to file personal tax extension Form 4868?

Why should you E-File Form 4868 with ExpressExtension

Express Guarantee*

Get an automatic refund of your filing fee if the IRS rejects your Form 4868 as a duplicate return.

Copy Return

Copy the data from a previously accepted return to speed up the filing process and reduce manual entry.

File from any Device

You can e-file your extension Form 4868 conveniently from any device, anywhere.

State Extensions

Easily complete and download your personal tax extension forms for certain states.

Volume Pricing

Volume-based pricing is available for tax professionals filing extensions in bulk.

Instant Notifications

After transmitting your 4868 Form, we provide instant notifications about its IRS status.

Free Retransmission

If your 4868 return is rejected by the IRS, you can correct the errors and retransmit it for free.

Seamless Support

Our live customer support team is available to assist you by phone, email, and live chat.

E-File a Form 1040 Extension now!

E-file Form 4868 Now

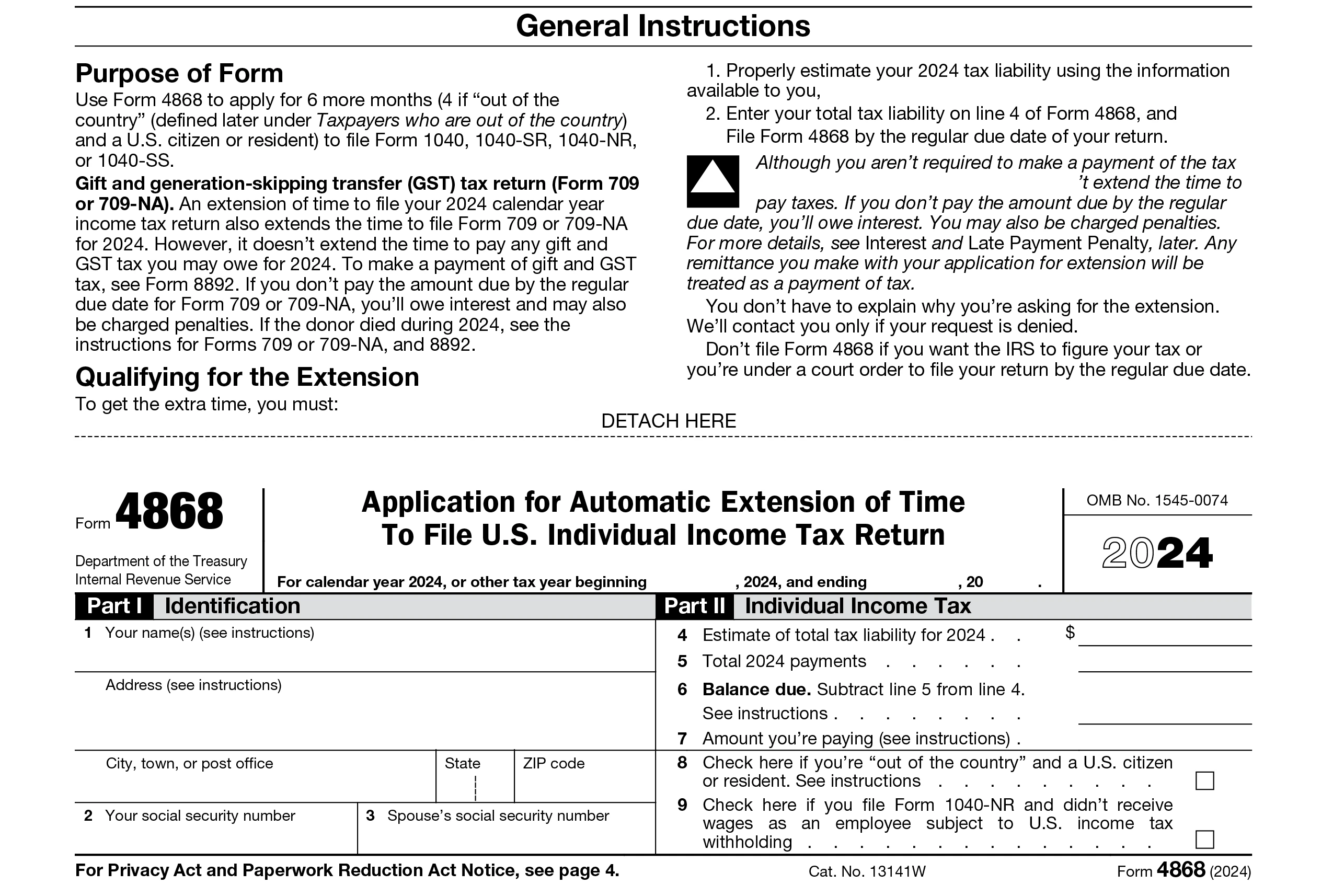

Information Required to file Personal Tax Extension Form 4868 Online for 2024 Tax Year

- Your basic details, including Name, Address, & SSN.

- Your spouse’s basic details (if you are filing a joint return).

- Total tax liability and payments for the 2024 tax year.

- IRS tax balance due, if any.

Note: Make sure your personal information matches the IRS database. You can verify your information with the IRS by contacting 1-800-829-4933.

State Extensions for Personal

Tax Returns

-

Certain states require individuals to file a separate extension form.

Learn more about your state tax extensions. - ExpressExtension has a simple process for completing and downloading your state tax extension forms.

Ready to Complete your State

Tax Extension?

Get Started Now

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners and Individuals Choice

Frequently Asked Questions on Personal Tax Extension

Form 4868

What is IRS Form 4868?

- IRS Form 4868 is used by U.S. individual taxpayers to request an extension of up to 6 months to file their personal income tax return.

- Since this is an automatic extension, the IRS doesn’t require taxpayers to provide a reason for requesting an extension. They only are required to provide accurate information and file personal tax extension form 4868 before the original filing deadline of their tax return.

Who can file Form 4868?

Form 4868 can be used by the Individual Income Tax Return Filers:

- U.S. Taxpayers who file Federal Individual Income Tax Returns (1040 Series)

- 1099 Independent Contractors

- Sole Proprietorships (Schedule C)

- Single-Member LLCs treated as disregarded entities

Which Forms does a Form 4868 Tax Extension apply to?

E-file form 4868 with the IRS to extend the deadline for following individual tax forms.

- Form 1040: U.S. Individual Tax Return

- Form 1040-SR: U.S. Tax Return for Seniors

- Form 1040-NR: U.S. Nonresident Alien Income Tax Return

- Form 1040-PR: Self-Employment Tax Return-Puerto Rico

- Form 1040-SS: U.S. Self-Employment Tax Return

To be eligible to file personal tax extension form 4868, you must request the extension by the original filing deadline and accurately estimate your 2024 tax liability.

Note: Form 4868 extension does not extend the time to pay taxes, you are required to pay any outstanding taxes by the original due date of your return.

When is the Personal Tax Extension Form 4868 Due to the IRS?

For the 2024 tax year, the due date to file Personal Tax Extension Form 4868 is April 15, 2025. Once the IRS approves your extension request, your deadline will be extended to October 15, 2025. Learn more about the 4868 deadlines.

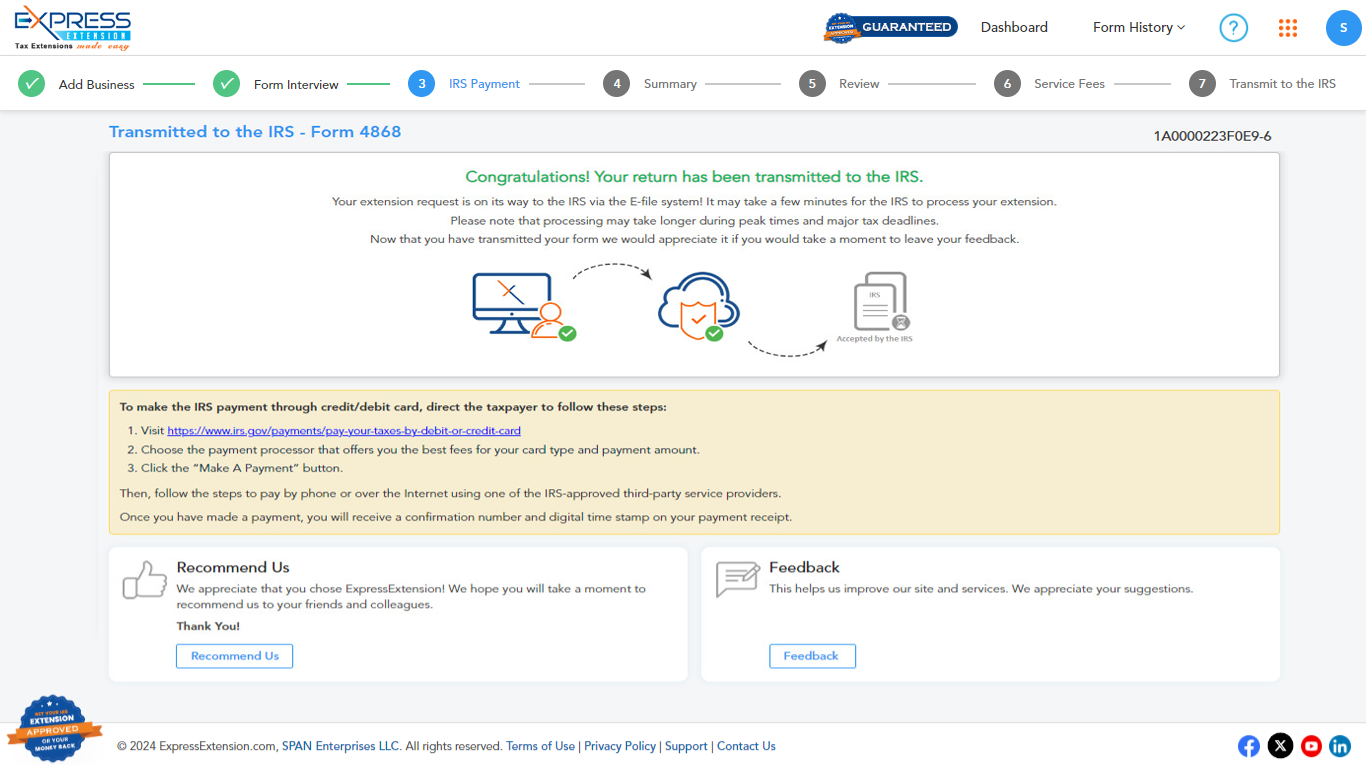

What Happens when you E-file personal income tax extension Form 4868 with ExpressExtension?

ExpressExtension, an IRS-authorized, e-file provider of IRS tax extensions, offers an easy and convenient option for requesting your personal tax extension.

- Under our Express Guarantee, the filing fee for any extensions that is rejected as a duplicate filing will be refunded automatically.

- We will send you email updates about the IRS status of your extension request.

- Our system audits your form for any IRS errors to ensure accuracy before transmission.

- If your 1040 extension form is rejected, we will notify you immediately and provide the IRS error code. You can then update and retransmit your form at no additional cost.

How do I File an Individual Tax Extension Online with ExpressExtension?

With ExpressExtension, you can file your 4868 Form in a few simple steps:

- Choose Form 4868

- Enter your personal details such as Name, Address, and SSN

- Enter your estimated taxes owed, if any

- Review your Form

- Transmit your Form 4868 to the IRS.

Ready to File your Personal Tax Extension?

Get Started NowHelpful Resources for Personal Tax Extension

Helpful Videos for Personal Tax Extension

Recent Questions about Personal Tax Extension Form 4868

Ready to File Personal Tax Extension

Form 4868?

Get started with ExpressExtension to file personal tax extension

Form 4868 in minutes