Key Insights: Form 7004 for Partnership Tax Extension

- Partnerships that require more time to file Form 1065 with the IRS can use Form 7004 to obtain an extension.

- Once Form 7004 is accepted by the IRS, the partnership is granted a 6-month automatic extension to file Form 1065.

- The deadline to file a partnership tax extension for the 2024 tax year is March 17, 2025.

Simplify Your Partnership Tax Extension Filing with ExpressExtension

Partnership - An Overview

A partnership is a business entity formed by two or more individuals or entities who jointly operate a trade or business. Each partner contributes capital, assets, or expertise and shares in the profits and losses based on the terms of the partnership agreement.

For federal tax purposes, partnerships must file Form 1065 (U.S. Return of Partnership Income). This form is an informational return that reports the partnership’s income, deductions, gains, and losses. While the partnership itself does not pay federal income tax, it is required to distribute profits and losses to its partners, who then report their share on their individual tax returns.

Each partner must receive a Schedule K-1 (Form 1065), which details their share of the partnership’s taxable income. Partners are not classified as employees and should not receive a Form W-2. Instead, they are responsible for reporting their allocated income and meeting their individual tax obligations.

When is the Deadline to File Form 1065?

The partnership must file Form 1065 by the 15th day of the 3rd month after its tax year ends.

For partnerships that follow a calendar year, the deadline to file Form 1065 for the 2024 tax year is March 17, 2025, since March 15, 2025, falls on Saturday.

If your partnership doesn’t operate on a calendar year, find out your due date here.

How to File 1065 Extension?

Partnerships that need more time to file their business tax return (1065) can request an automatic 6-month extension by filing Form 7004 with the IRS.

File Form 7004 by the original due date of the partnership tax return to get approved by

the IRS.

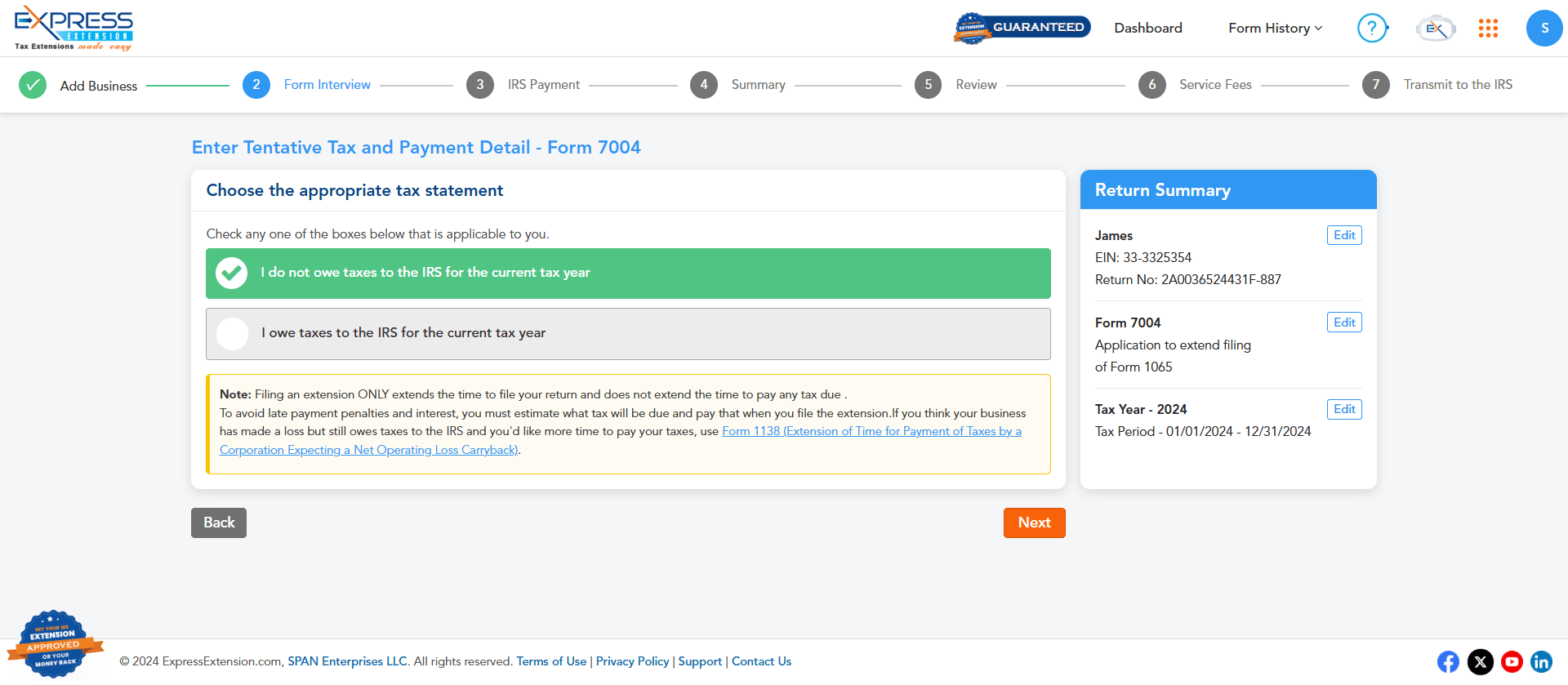

Note: The partnership tax extension applies only to filing the tax return. Partnerships must still pay any tax owed by the original deadline to avoid penalties and interest.

What are the Penalties Associated with Partnership Tax Return Form 1065?

If a partnership must file Form 1065 by the required deadline but either miss the deadline (including extensions) or submit an incomplete return, the IRS will charge a penalty—unless there’s a valid reason for the delay.

The IRS charges a penalty of $245 for each month (or part of a month) multiplied by the total number of partners involved during the tax year.

File Your Partnership Tax Extension with ExpressExtension

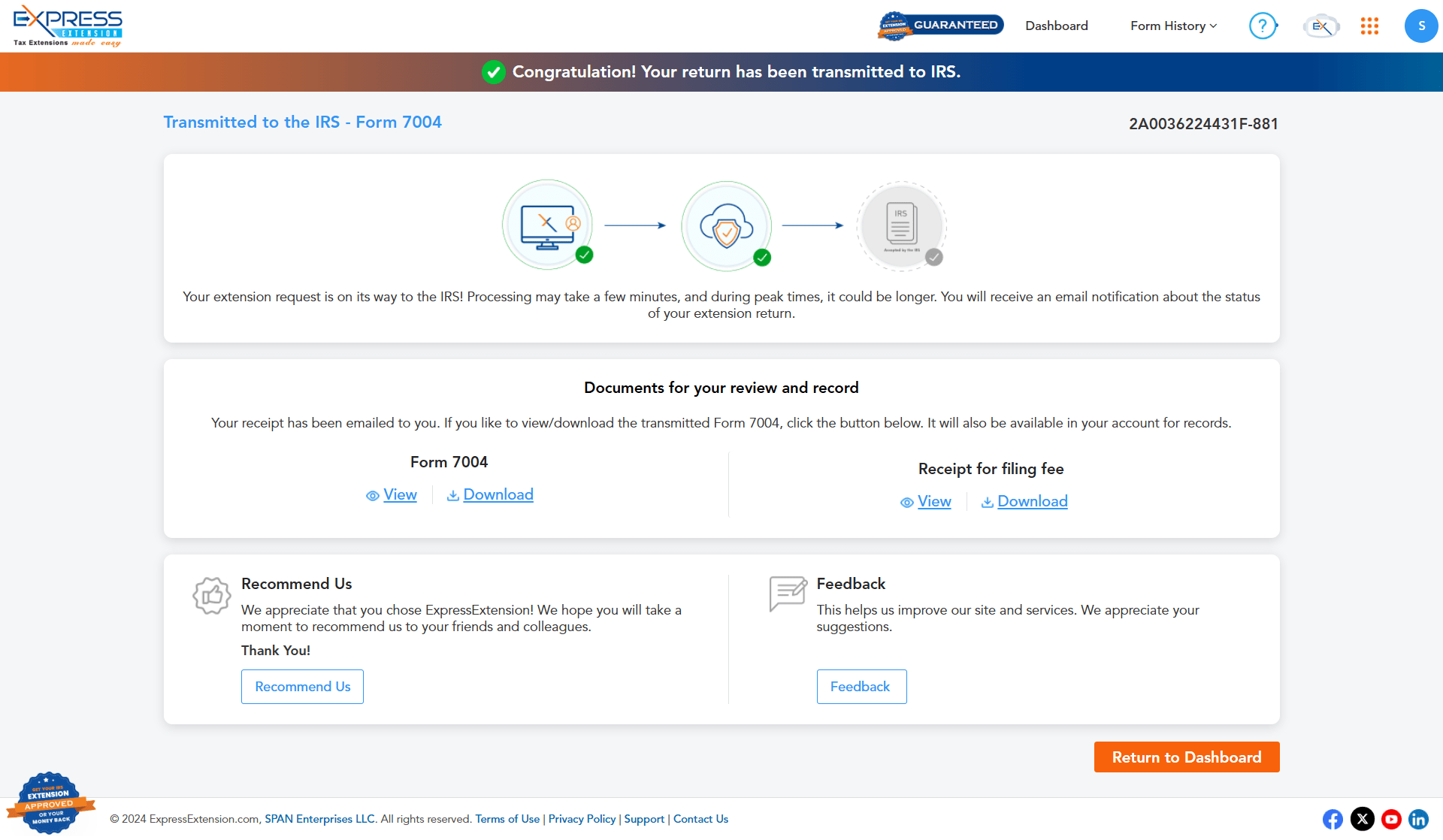

ExpressExtension, as the IRS- IRS-authorized e-file service provider for tax extension, simplifies the extension filing process and makes it easier to e-file Form 7004 in minutes.

State Tax Extension for Partnerships

Apart from federal extension, some states require Partnerships to file an extension at the state level to file their state business tax returns.

With ExpressExtension, you can file your state tax extension with the IRS and State.

ExpressExtension simplifies the filing of partnership tax extension by following these

simple steps:

-

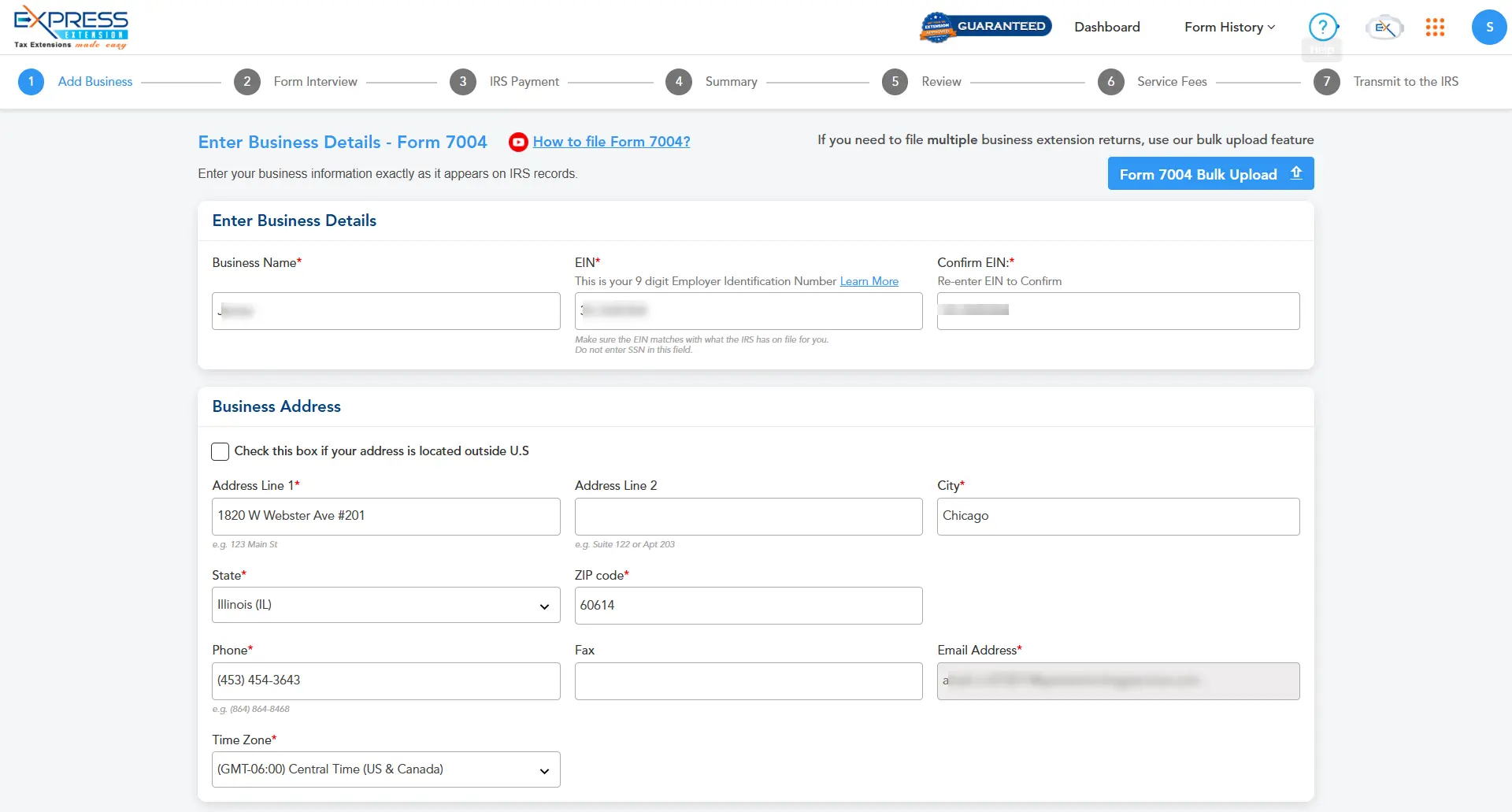

Step 1:

Choose Form 7004 and enter your basic business information

-

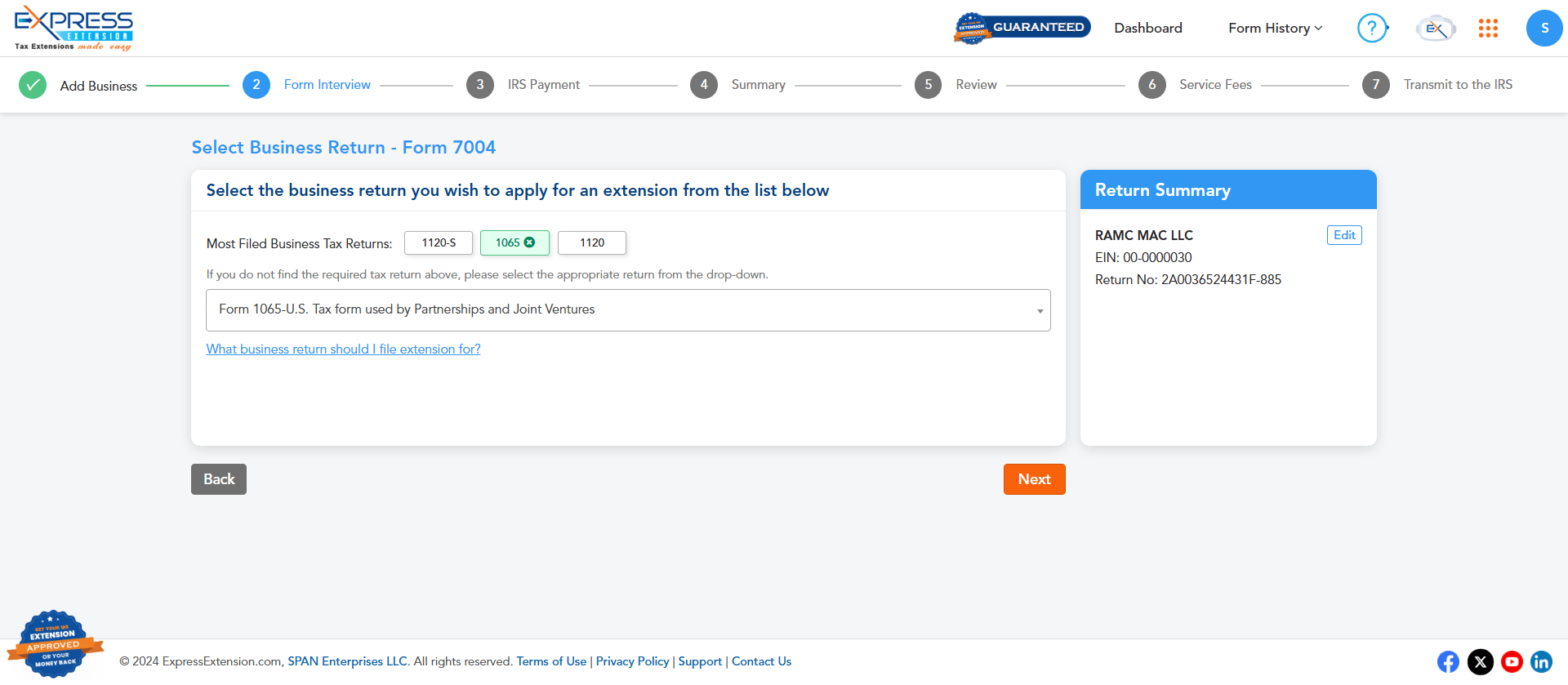

Step 2:

Select the form (1065) for which you need to request an extension

-

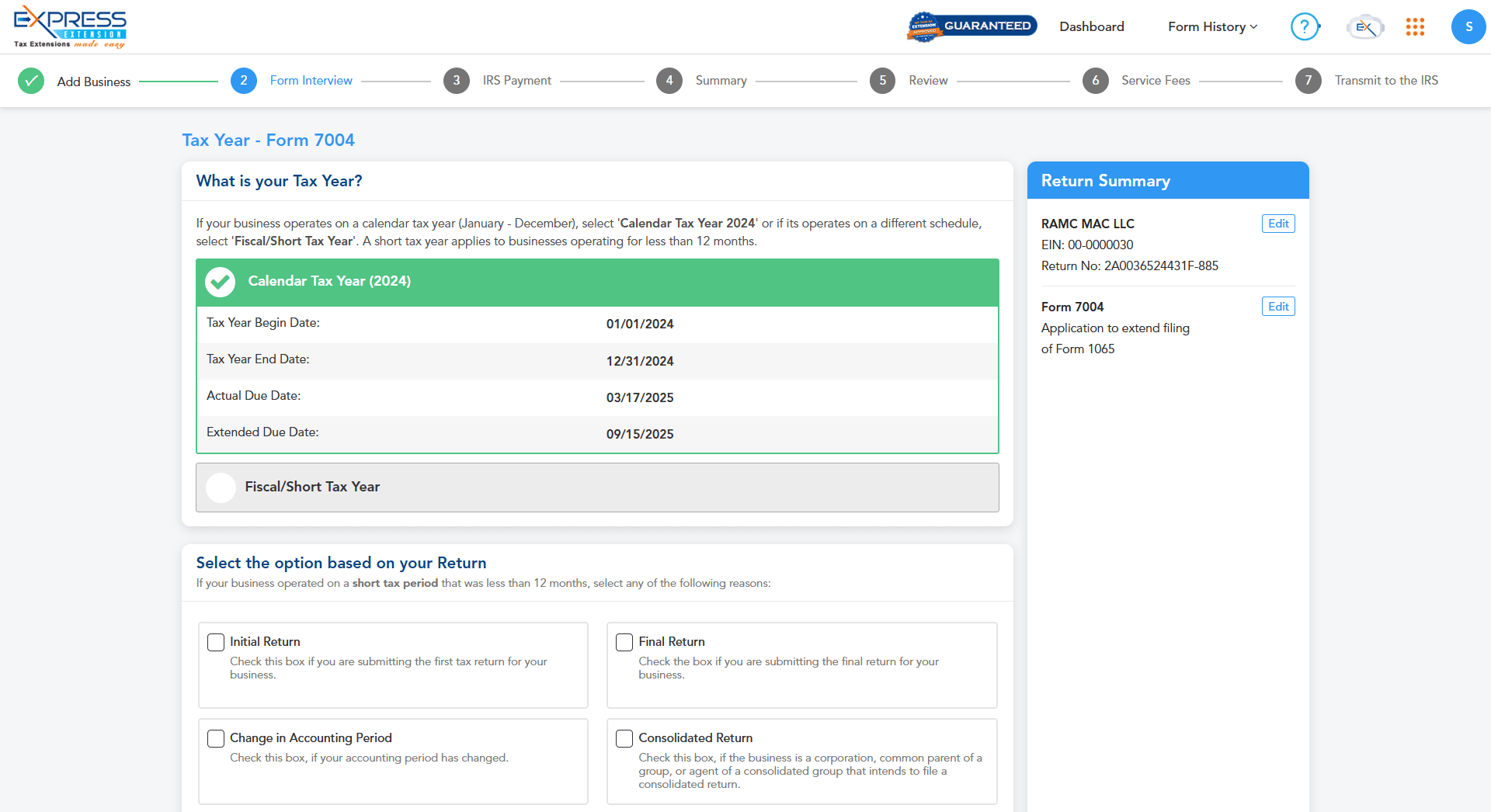

Step 3:

Enter the form details, complete the tax payment (EFW or EFTPS), and transmit the form to the IRS.

Our world-class support team is available by phone, email, and live chat to assist you during the filing process.

How to E-file Partnership Tax Form 1065 Extension?

Get Started Today and File Partnership Extension Form 7004 from any Device!

E-File 7004 NowSee why our customers choose us year after year

ExpressExtension - The Smart Business Owners Choice

Frequently Asked Questions about 1065 Extension