Reminder: The IRS has announced tax relief for filers from Oklahoma, Louisiana, Tennessee & Texas due to the severe winter storm crisis. This tax relief grants Individuals and Business owners additional time to file their tax returns until June 15, 2021.

E-filing your Nonprofit Tax Extension with ExpressExtension is Easy!

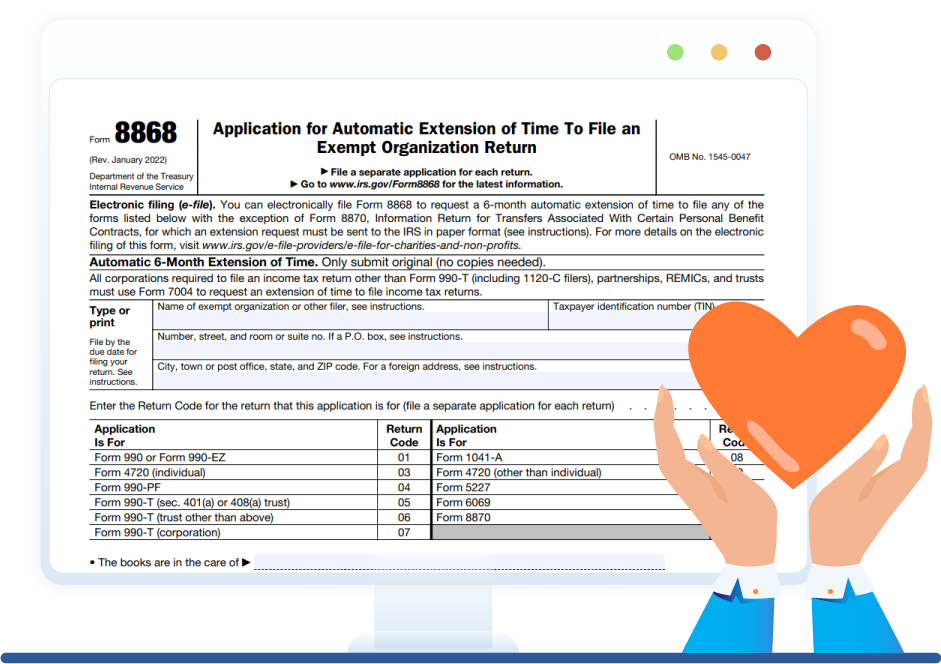

Choose Form 8868 and Enter Data

Pay IRS Balance Due

E-file with the IRS

Get Started Today to file Form 8868 from Any Device!

Get Started Now!Benefits of E-filing your Nonprofit Tax Extension with ExpressExtension

Federal Tax Extensions

File Tax Extension Form 8868 to the IRS and extend the nonprofit tax filing deadline for up to 6 months.

Easy Data Import Options

Import all of your 8868 data at once using our Secure Upload (Excel) Template or choose Manual Entry.

Volume Based Pricing

Filing multiple 8868 Forms? With volume-based pricing, the more forms you file, the more you save!

File from Any

Device

You can conveniently file your Federal nonprofit tax extension Form 8868 from any device, anywhere.

Option to Pay Balance Due

If you are filing an extension for

990-PF or 990-T, you can pay your balance tax due using EFW or EFTPS.

Error-FREE

Filing

Internal Audit Checks find common errors, helping you transmit error-free 8868 returns.

Instant Notifications

Get instant status updates about your extension right from your Dashboard, Email, and mobile device.

Free Retransmission

If your extension is rejected for any other reason, you may fix the error and retransmit to the IRS for FREE.

24/7 - US Based Support

Our support team helps you to resolve any queries related to the extension through Email or Phone.

See why our customers choose us year after year

ExpressExtension - The Smart Choice for Nonprofit

Connect with

The ExpressExtension Team

Our team is here to help you by phone, email,

and live chat