What information is required to create pay stubs online?

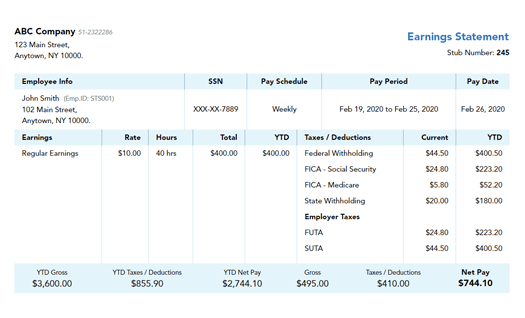

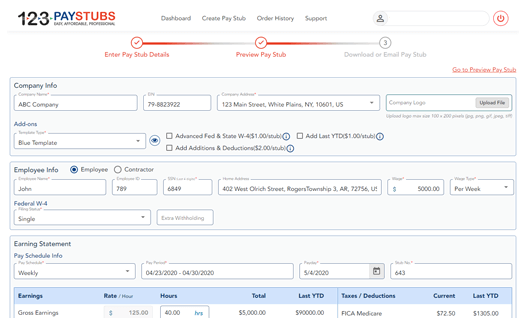

- Company Info: Name, EIN, and Address

- Employee or Contractor Info: Name, ID, SSN, Address & Salary

- Federal & State W-4: Deductions and Withholding amounts

- Pay Schedule Info: Pay schedule, Pay period, and Payday

- Gross Earnings: Hours Worked

- YTD Details: Year to Date (YTD) values

- Additional Earnings & Deductions if any

If you have the above information ready, you can start creating paystubs with our paystub creator.

Create Pay Stub in 3 Simple Steps with our Paystub Creator

Enter Your Information

Preview or Edit paystub

Download or Email paystub

Create Paystubs using our Android and iOS Mobile App

Create pay stubs on the go. It's simple, easy, and accurate.

Frequently Asked Questions on Pay Stubs

How can I get my pay stub for free?

All you have to do is to visit 123paystubs.com and enter the required information such as company and basic employee and earnings details. You can then preview paystub, and continue to download it for free. All the calculations are accurate and will be calculated automatically based on the information that you provide. You can even add the second paystub to your order, but remember only the first paystub will be free of cost and you will be charged for the second paystub.

Can I change the paystub template after creating a paystub?

Yes, you can change the paystub template even after generating the paystub. You can preview, and change the paystub template as per your needs. The templates we offer are in different designs and styles. You can choose from any of our pay stub templates and

it is totally free.

How do I create a pay stub for a self-employed or contractor?

Be it an employee or contractor, you can create paystubs as simple as 1-2-3 with our paystub generator. There is no difference in the steps. You have to just choose a contractor and continue adding the required paystub information. And finally, you can

download it quickly.

Can I calculate the payroll deductions using 123 Paystubs?

Yes, you can calculate your payroll deduction with 123PayStubs. Our check stub maker is integrated with advanced payroll software, enabling you to accurately calculate all types of payroll deductions based on the current tax laws.

Get started today and generate your check stubs accurately based on current tax laws with 123PayStubs.

Why choose 123 PayStubs?

123PayStubs is one of the leading Paystub maker used by businesses of all sizes. 123 are great tools for businesses that manage their pay stubs on their own. Our check stub generator is equipped with various features to make your payroll experience hassle-free. Here are some of the benefits you get while creating check stubs with 123PayStubs.

- Accurate Tax Calculation, FUTA & SUTA taxes, and Social security and Medicare tax calculations

- Create your first pay stub for free

- Supports Form W-4 for calculating federal withholding

- Make unlimited corrections free of cost

- Wide range of professional pay stubs templates

- Generate pay stubs with your company logo

- Manage additional earnings and deductions

Ready to use our free pay stub creator?

Get started now and create pay stubs in minutes.