How to File Form 4868 online for 2024 tax year?

Follow these Steps to File Form 4868 online in less than 5 Minutes

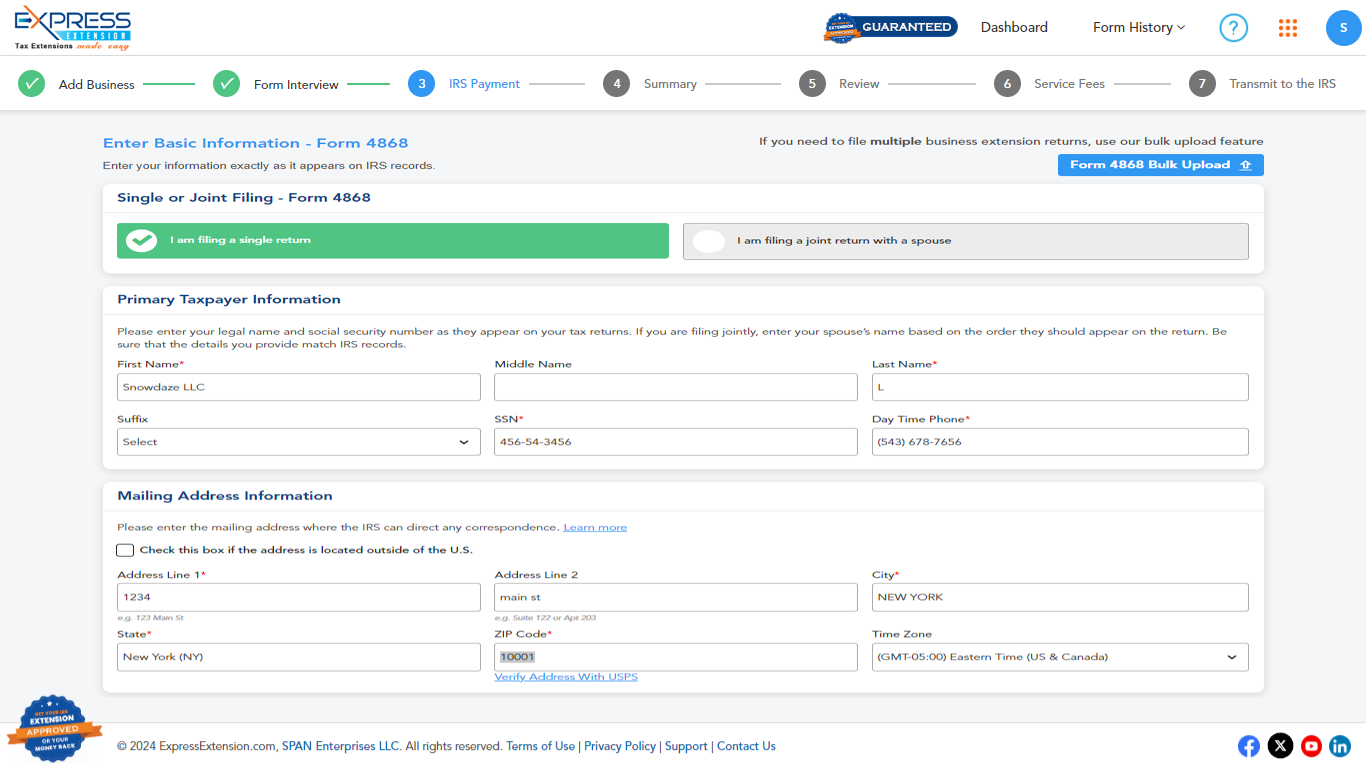

Enter your details, SSN, Address, and Mobile Number to start filling out the form

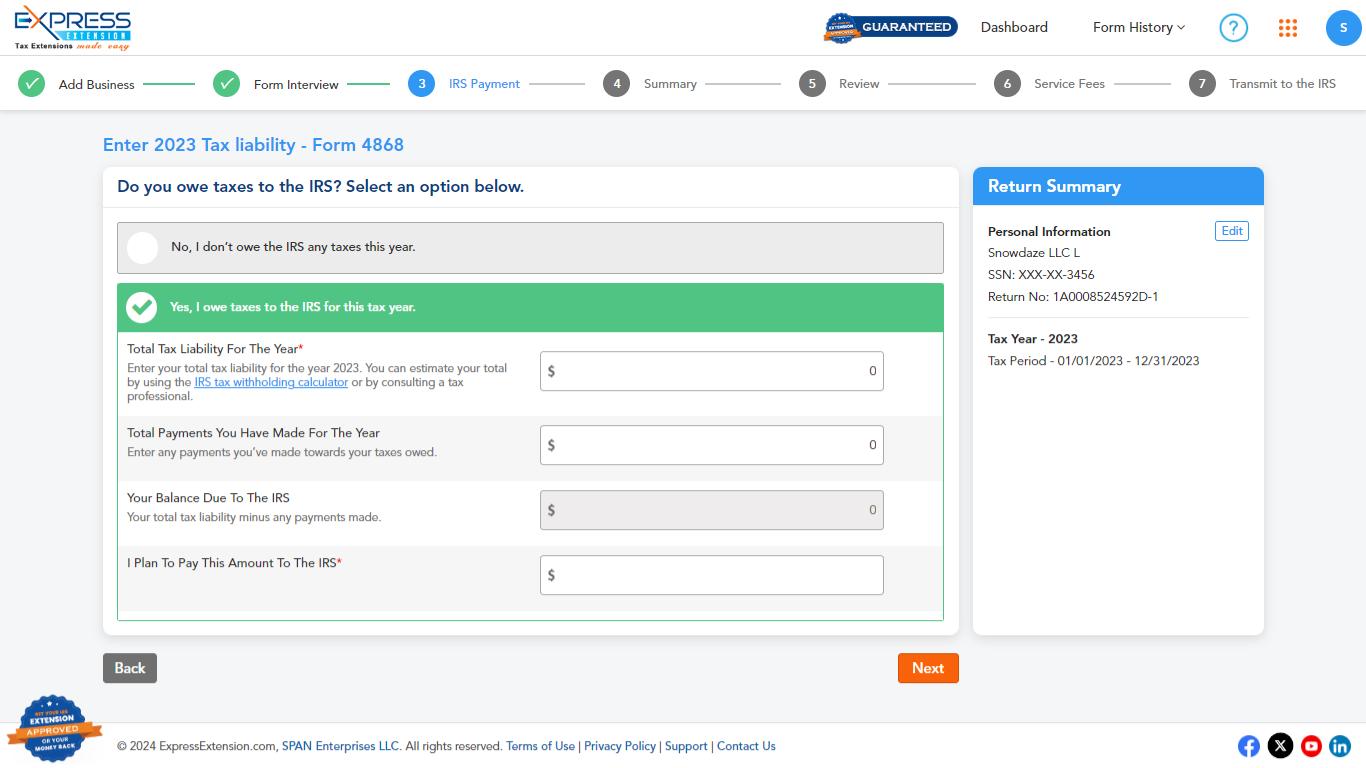

Choose whether you owe any taxes to the IRS

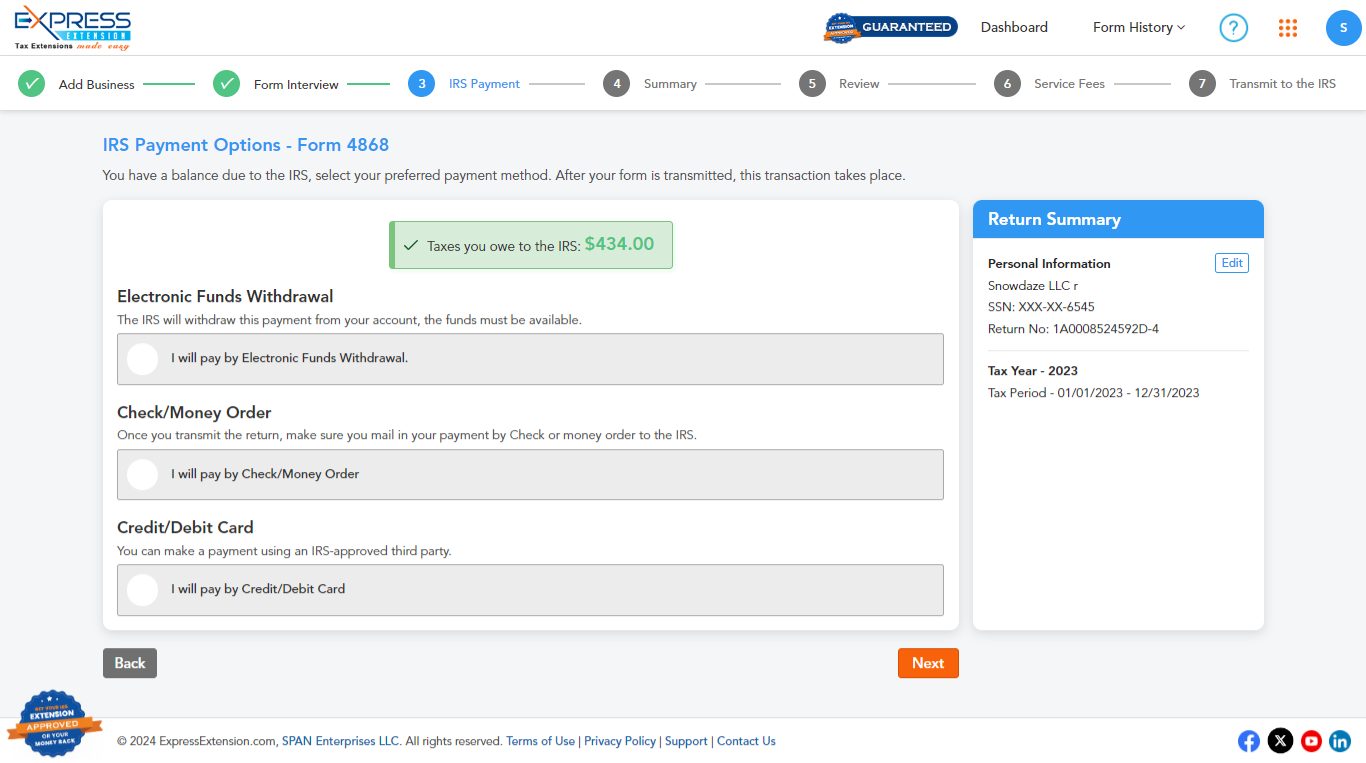

Select the payment mode you need to transmit to the IRS

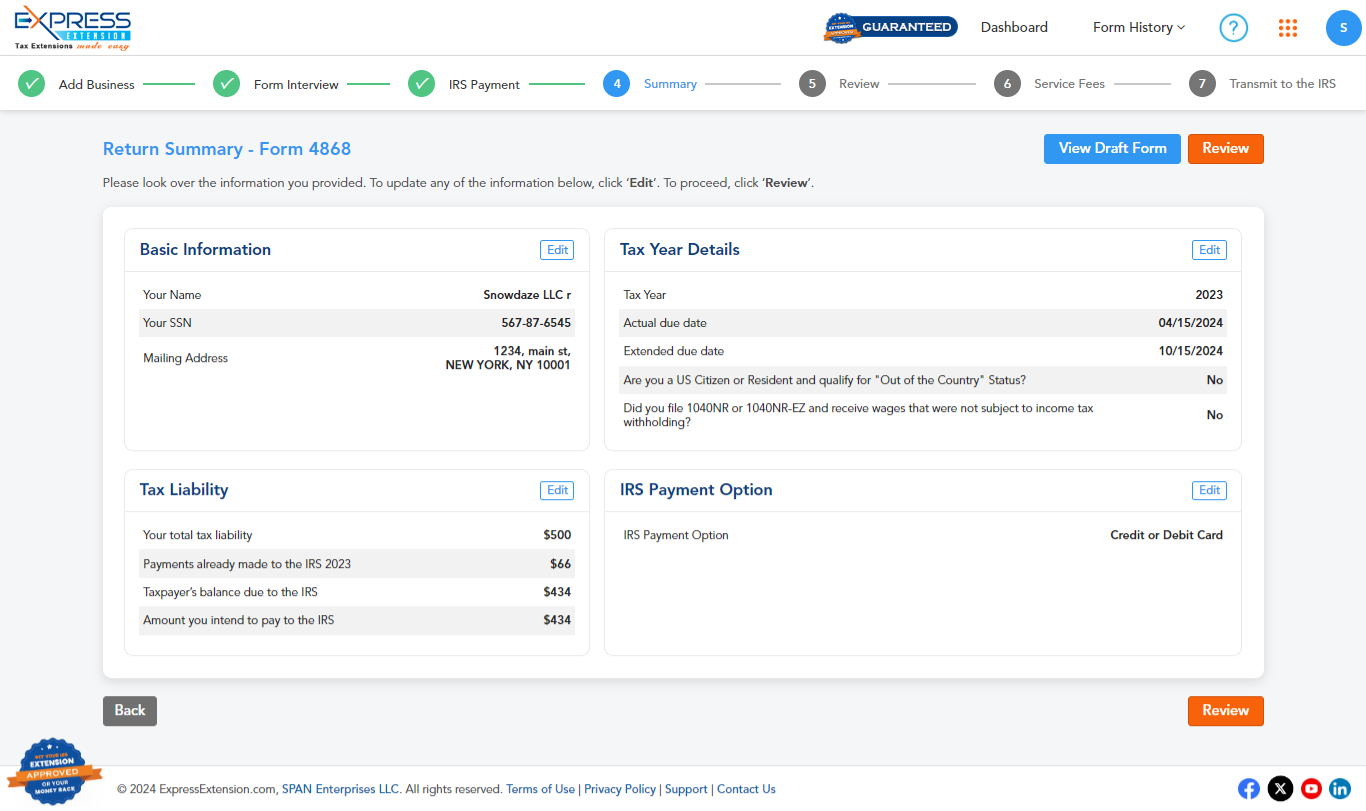

Once you choose the payment mode, review your form

Once reviewed, you can transmit the return to the IRS.

Get Started today and E-File Form 4868 from any device!

Why should you E-File Form 4868 with ExpressExtension

Express Guarantee*

Get an automatic refund of your filing fee if the IRS rejects your Form 4868 as a duplicate return.

IRS-Authorized

We are an IRS-authorized e-file provider that simplifies the filing of personal tax extensions.

File from any Device

You can e-file your extension Form 4868 conveniently from any device, anywhere.

State Extensions

Easily complete and download your personal tax extension forms for certain states.

Volume Pricing

Volume-based pricing is available for tax professionals filing extensions in bulk.

Instant Notifications

After transmitting your 4868 Form, we provide instant notifications about its IRS status.

Free Retransmission

If your 4868 return is rejected by the IRS, you can correct the errors and retransmit it for free.

Seamless Support

Our live customer support team is available to assist you by phone, email, and live chat.

E-File a Form 1040 Extension now!

E-file Form 4868 Now

Information Required to

E-File

Form 4868

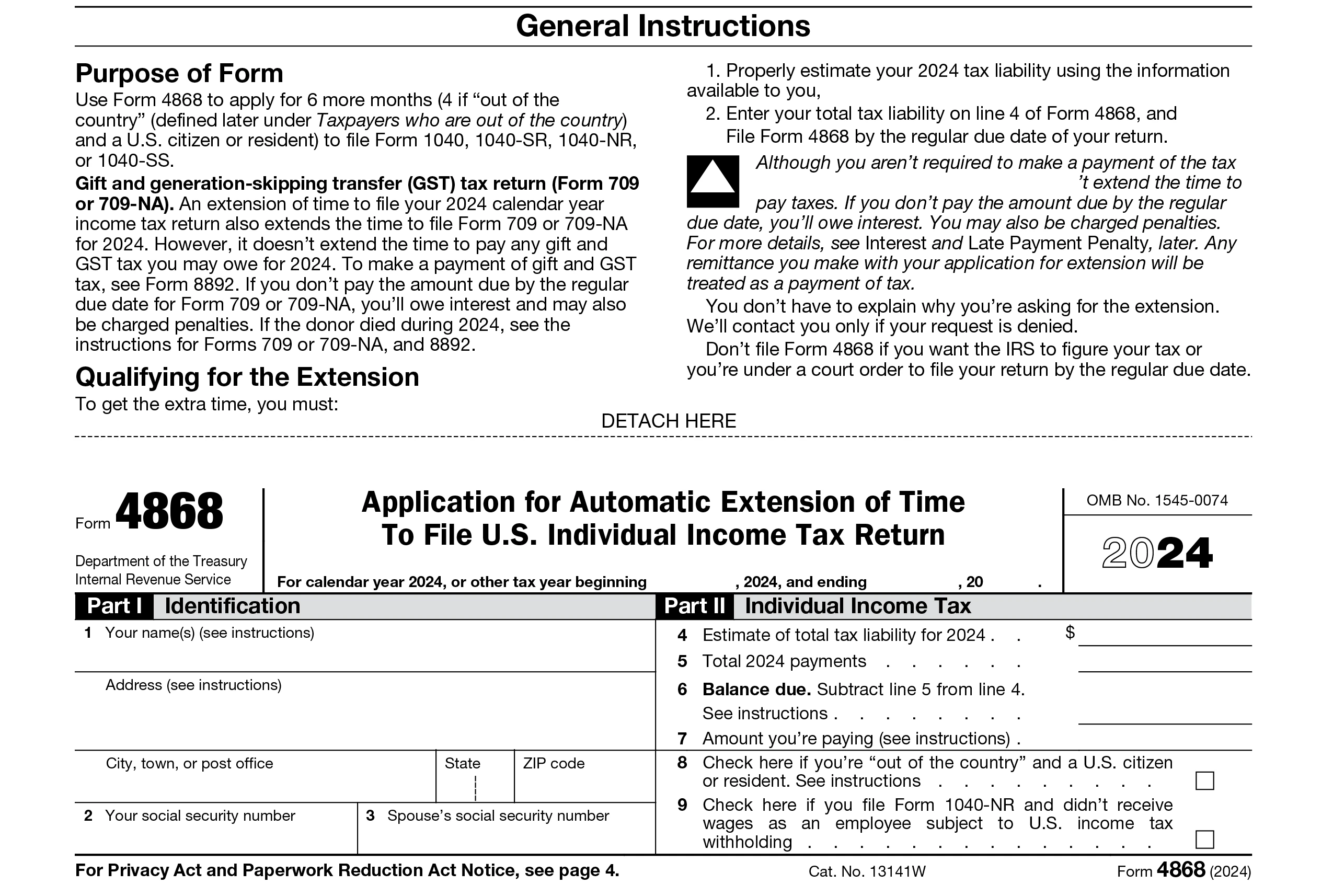

In order to e-file Personal Tax Extension Form 4868, you’ll need the following information:

- Your basic details, such as Name, Address, & SSN.

- Your spouse’s basic details (if you are filing a joint return)

- Total Tax liability and Payment for the 2024 tax year.

- Tax Balance due, if any.

File 1040 Extension from

any device

E-File 4868 Now

State Extensions for Personal

Tax Returns

- Certain states require individuals to file a separate extension form.

Learn more about your state tax extensions. - ExpressExtension offers a simple process for completing and downloading your state tax extension forms.

Ready to Complete your State

Tax Extension?

Get Started Now

See why our customers choose us year after year

ExpressExtension - The Smart Business Owners and Individuals Choice

Why should you E-file 4868 Form with ExpressExtension?

IRS Authorized E-File Provider

ExpressExtension is one of the trusted E-file Providers supporting individual income taxpayers to file a tax extension form with the IRS.

Automatic Extension

The IRS provides an automatic 6 month extension without asking any reasons when extension is filed using Form 4868.

Apply tax extension in Minutes

You can easily e-file your Form 4868 with the IRS in minutes with our step-by-step filing process and clear help texts.

Instant IRS Approval

Once you E-File form 4868, You can expect instant approval from the IRS.

File from any Device

You can E-File Form 4868 from any device as your wish. Tax Extension 4868 is possible on any device without any limitations.

Instant Notification

You will be notified about your Filing status via email and phone notifications.

Re-transmit Rejected Returns for Free

We re-transmit your rejected returns for free in case your 4868 application is rejected by the IRS.

Exclusively for Tax rofessionals

We provide the bulk filing capabilities and the discounts on pricing based on the Volume of the returns to make it simple for Bulk filers.

Frequently Asked Questions to File Form 4868 online

What is IRS Form 4868?

- The IRS Form 4868 is a tax extension form used by U.S. individual taxpayers to request an extension of up to 6 months to file their personal income tax return.

- Taxpayers who file Personal Tax Extension Form 4868 are not required to provide a reason for requesting an extension, as this extension is automatic.

- IRS Form 4868 also provides tax extensions for 1099 Contractors, Single Member LLCs, and Schedule C Sole Proprietors.

Note: The Form 4868 tax extension does not apply to making tax payments. Outstanding taxes must be paid by the

original deadline.

When is the Deadline to File Form 4868 for Tax Year 2024?

Form 4868 must be filed on or before the deadline for the tax form that you are requesting the extension.

For the 2024 tax year, Form 4868 is due by April 15, 2025. If you’re out of the country, you can file your return or this form by June 16, 2025.

What are the late filing penalties for the individual tax

return 1040?

The penalty for late filing of Form 1040 is

- 5% of the unpaid taxes for each month or part of the month that your return is late. The maximum penalty is 25% of

your unpaid tax. - If the 1040 tax return is more than 60 days late, the minimum penalty is $450 or 100% of the unpaid tax, whichever is smaller.

Failure-to-file penalties typically cost more than failure-to-pay penalties. To learn more about penalties, visit irs.gov.

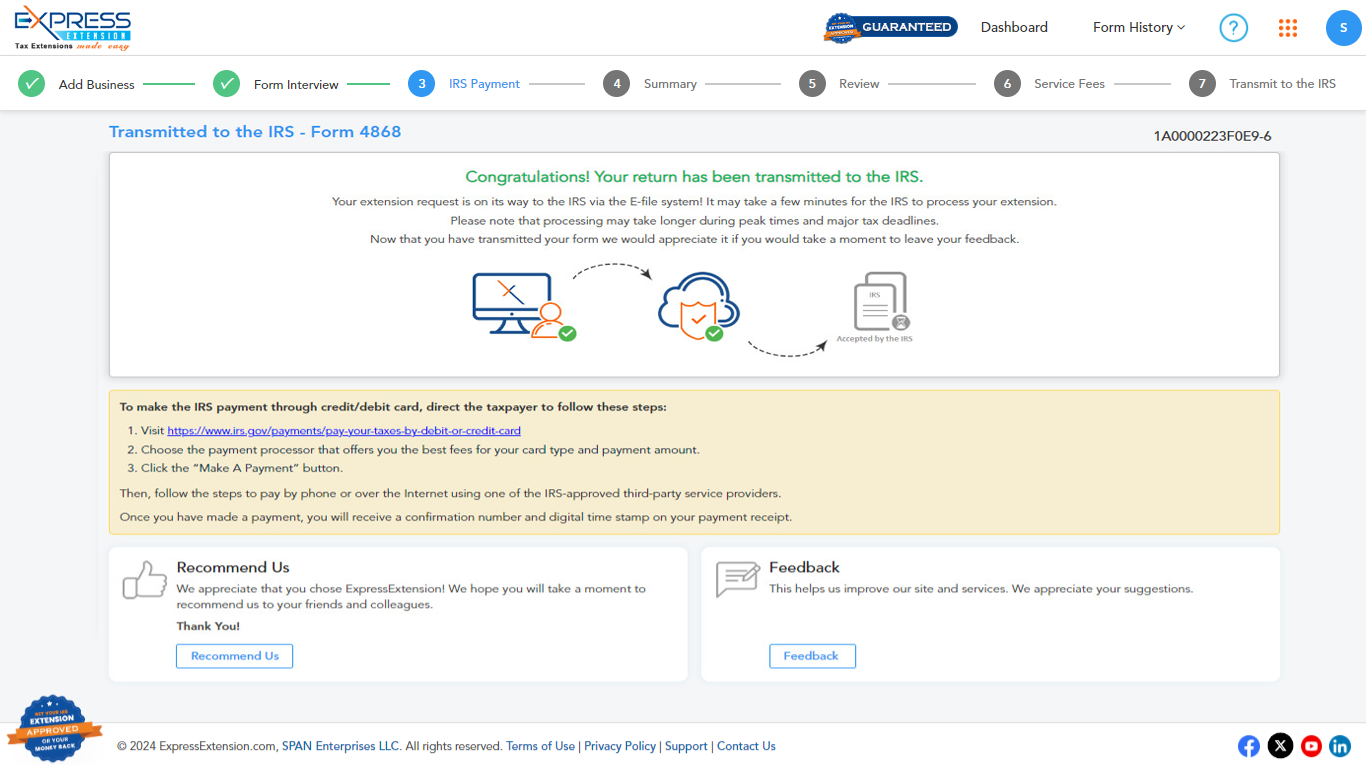

How do I E-file 1040 Extension Form 4868 with ExpressExtension?

Here’s how you can quickly e-file Form 4868 with ExpressExtension:

- Select Form 4868

- Enter Personal Details

- Enter the Payment Details

- Review your Form

- Transmit your Form to the IRS.

Ready to E-File Form 4868?

Helpful Resources for 1040 Extension Form 4868 Filing

Ready to file Form 4868 Online?

Get started with ExpressExtension to file your 1040 extension form 4868 in minutes