Get 10% OFF on your 7004 and 4868 filing fee

Use Coupon Code - TAXDAY10 Click here to Copy at checkout (Valid until April 15, 2025)

Understanding Form 7004

- Updated on April 07, 2025 - 8.00 AM Admin, ExpressExtensionAs a business, managing tax deadlines is a key part. If you need additional time to file your business tax return, Form 7004 allows you to request an automatic extension, helping you stay compliant and avoid late filing penalties.

In this article, we will cover the basics of Form 7004, including its purpose, filing requirements, deadlines, and more.

Key Takeaways About Form 7004

- Form 7004 is used to request an automatic extension (6 months) of time to file certain business tax returns, but it does not extend the time to pay any taxes due.

- C-Corp, S-Corp, partnerships, multi-member LLCs, and certain estates and trusts can file Form 7004.

- Form 7004 extends the deadline for several tax forms, such as Form 1120 (corporate returns), Form 1065 (partnership returns), and many other business tax returns.

Looking to File Form 7004?

Get started today with ExpressExtension to e-file Form 7004 in minutes. Receive instant IRS approval and effortlessly extend your business tax deadline until October 15!

E-File 7004

Table of Contents

What is Form 7004?

Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, allows businesses, other entities, and trusts to request additional time to file their tax returns. This automatic extension gives businesses up to six extra months to file, but it does not extend the deadline to pay any taxes owed.

Because the extension is automatic, businesses do not need to provide a reason for the delay—simply filing Form 7004 is sufficient. It applies to various business tax returns, helping entities stay compliant even if they cannot meet the original filing deadline.

Who Can File Form 7004?

Most businesses can use Form 7004 to request an extension of time to file various tax returns. This

may include:

- C Corporations: Businesses structured as separate legal entities from their owners with double taxation, where both corporate profits and shareholder dividends are taxed. They must

file Form 1120 to report income, deductions, and tax liability. Form 7004 allows a six-month extension to file this return. - S Corporations: A special type of corporation that allows income, losses, deductions, and credits to pass through to shareholders for tax purposes. They are required to file Form 1120-S and can use Form 7004 to request an extension, though this does not extend the deadline for issuing Schedule K-1s to shareholders.

- Partnerships: A business structure where two or more individuals share ownership and the profits or losses. They must file Form 1065 to report income and distributions. Form 7004 extends the 1065 filing deadline but not the due date for providing K-1s to partners.

- LLCs: A Limited Liability Company (LLC) that has more than one owner (member) and offers liability protection. Single-member LLCs taxed as corporations and multi-member LLCs taxed as partnerships or corporations must file the corresponding tax form (1120, 1120-S, or 1065). If taxed as a corporation or partnership, the LLC can use Form 7004 to request an extension.

- Certain estates and trusts: Legal entities created to manage assets for beneficiaries, which may be required to file income tax returns. These entities are required to file Form 1041 and can request an extension using Form 7004.

Get an Instant Business Tax Extension

with Ease!

Filing Form 7004 through ExpressExtension is fast and simple. Submit your extension request in just a few clicks and get instant IRS approval! E-File 7004

Which Business Tax Return Deadlines Do the Form 7004 Extend?

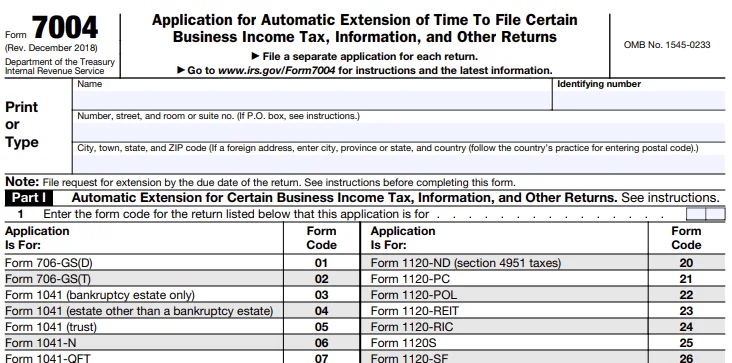

Form 7004 requests an automatic extension of time to file various business income tax, information, and other returns. Here are the key forms that can be extended using Form 7004:

- Form 706-GS (D), Generation-Skipping Transfer Tax Return for Distributions

- Form 706-GS (T), Generation-Skipping Transfer Tax Return for Terminations

- Form 1041, U.S. Income Tax Return for Estates and Trusts

- Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

- Form 1041-QFT, U.S. Income Tax Return for Qualified Funeral Trusts

- Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

- Form 1065, U.S. Return of Partnership Income

- Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

- Form 1120, U.S. Corporation Income Tax Return

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations

- Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation

- Form 1120-H, U.S. Income Tax Return for Homeowners Associations

- Form 1120-L, U.S. Life Insurance Company Income Tax Return

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return

- Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies

- Form 1120S, U.S. Income Tax Return for an S Corporation

- Form 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B)

- Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner

- Form 8612, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts

- Form 8613, Return of Excise Tax on Undistributed Income of Regulated Investment Companies

- Form 8725, Excise Tax on Greenmail

- Form 8804, Annual Return for Partnership Withholding Tax (Section 1446)

- Form 8831, Excise Taxes on Excess Inclusions of REMIC Residual Interests

- Form 8876, Excise Tax on Structured Settlement Factoring Transactions

- Form 8924, Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests

- Form 8928, Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

Note : Form 7004 cannot be used to request an extension for Form 1041-A (U.S. Information Return Trust Accumulation of Charitable Amounts) . Instead, you should use Form 8868 (Application for Extension of Time To File an Exempt Organization Return or Excise Taxes Related to Employee Benefit Plans), specifically designed to extend the filing deadline of various tax-exempt organization returns.

What Information is Required to File Form 7004?

To file Form 7004, you must provide key details about your business or entity. Here’s what you’ll need:

- Legal Name: Enter the exact name of the business or entity as registered with the IRS.

- Mailing Address: Provide the current address where correspondence should be sent.

- Employer Identification Number (EIN): Include the EIN assigned to the business or entity.

- Form Code: Indicate the code for the tax return you’re requesting an extension for, as listed in the IRS instructions.

- Tax Year: Specify whether the entity follows a calendar year or a fiscal year, and enter the beginning and ending dates if using a fiscal year.

When is the Due Date to File Form 7004?

- Form 7004 deadline is the same as the original deadline for the business tax return for which the extension is required.

- If the due date falls on a Saturday, Sunday, or a federal holiday, the next business day will be the due date.

- For example, if your business needs to file an extension for Form 1065 or 1120-S for the current tax year, the deadline is March 17, 2025.

Click here to learn more about the deadline for the specific extension forms.

Still confused about your due date? Use our Due Date calculator to find the due date for

your business.

What are the Penalties for Late Filing of Form 7004?

The penalties for late filing of Form 7004 can vary depending on whether the issue is related to late filing or late payment of taxes.

- Late filing penalties: Generally, a penalty will be imposed if you file the return after the due date, including extensions, and you can’t demonstrate reasonable cause.

- Late Payment Penalty: If you don’t pay your tax due by the deadline, a penalty of 0.5% per month or part of a month on the unpaid tax amount is charged. This penalty can accumulate up to a maximum of 25% of the unpaid tax. However, if you can show reasonable cause for the delay in payment, this penalty may be waived.

Note: If a corporation receives an extension to file its income tax return, it will avoid the late payment penalty if:

- The tax paid by the original due date is at least 90% of the total tax due.

- Any remaining balance is paid by the extended due date.

How to File Form 7004?

You can file your extension Form 7004 either by paper or electronically. However, the IRS recommends e-filing for a faster and more efficient process. If you opt to file on paper, you must complete the form with all the required information and mail it to the appropriate IRS address.

Note: The IRS mailing address varies depending on the specific form for which you request an extension. To find the correct mailing address for your form, click here.

File Form 7004 in Minutes with ExpressExtension

ExpressExtension is the leading SOC-2-certified e-file service provider that simplifies your extension request process. We offer comprehensive solutions for tax professionals and businesses of all sizes to e-file Form 7004.

Our software features an intuitive, user-friendly interface, ensuring a streamlined, secure, and accurate filing experience. Moreover, if the IRS has rejected your extension, you can easily fix the errors and re-transmit it to the IRS free of cost.

Filing Form 7004 with ExpressExtension is quick and easy. In just a few minutes, you can have your extension approved!

Our Customer Reviews

Trusted and loved by users like you.

4.8 rating of 12,784 reviews

Ready to File Business Tax Extension Form 7004 Online?

Get Started with ExpressExtension & file your form in minutes